GreyRhino newsletter Edition June 2025

Discover the GreyRhino Newsletter by iMB.Solutions!

Stay ahead of the curve with the GreyRhino newsletter, your go-to source for insightful analysis and expert commentary straight out of the project missions. Curated by iMB.Solutions, this newsletter dives deep into the "grey rhino" events—highly probable, high-impact threats that we often overlook.

Why Subscribe?

Expert Insights: Gain access to Frank P. Neuhaus's unique perspectives and in-depth analysis on global risks and opportunities.

Timely Updates: Stay informed with the latest developments and trends that could impact your business and personal life.

Actionable Advice: Learn practical strategies to navigate and mitigate risks, ensuring you're always prepared for what's next.

Join a community of forward-thinking professionals who are committed to staying informed and proactive. Don't miss out on the valuable knowledge and insights shared in the GreyRhino newsletter.

📥 Subscribe now on iMB.Solutions webpage and turn potential threats into opportunities!

Sign up with your email address to receive news and update!

Prime Story

Brazil’s Electric Awakening: Denza, Geely & GWM Usher in a Bold New Era of Mobility

Brazil is not just warming up to the electric revolution—it’s throwing open the gates. With 2025 under full steam, the country’s automotive landscape is shifting into high gear. Three Chinese giants—Denza, Geely, and GWM—are setting the stage for an electrifying transformation, each with unique strategies and bold ambitions to redefine mobility in Latin America’s largest economy.

Denza Arrives in Brazil: A Premium Power Move by BYD

Luxury and innovation are coming together as Denza, the high-end sub-brand of BYD, officially enters the Brazilian market in 2025. Originally founded in 2010 as a joint venture between BYD and Mercedes-Benz, Denza was designed to fuse German engineering excellence with Chinese electric know-how. Now fully under BYD’s wing, Denza is ready to shine on its own.

What can we expect?

Denza D9: A refined all-electric minivan with generous space and comfort—ideal for families and executive travel.

Denza N7 (B5): A robust plug-in hybrid SUV built on the same DMO platform as the BYD Shark pickup, offering off-road capability with a luxury twist.

Denza Z9 GT: A sport wagon that speaks to performance lovers and connoisseurs of elegant, dynamic design.

BYD will roll out Denza through its exclusive dealership network, delivering a curated luxury experience. With an increasingly tech-savvy and sustainability-conscious consumer base, Brazil is the perfect launchpad for Denza’s next chapter.

up: Denza B5 - down: Denza D9

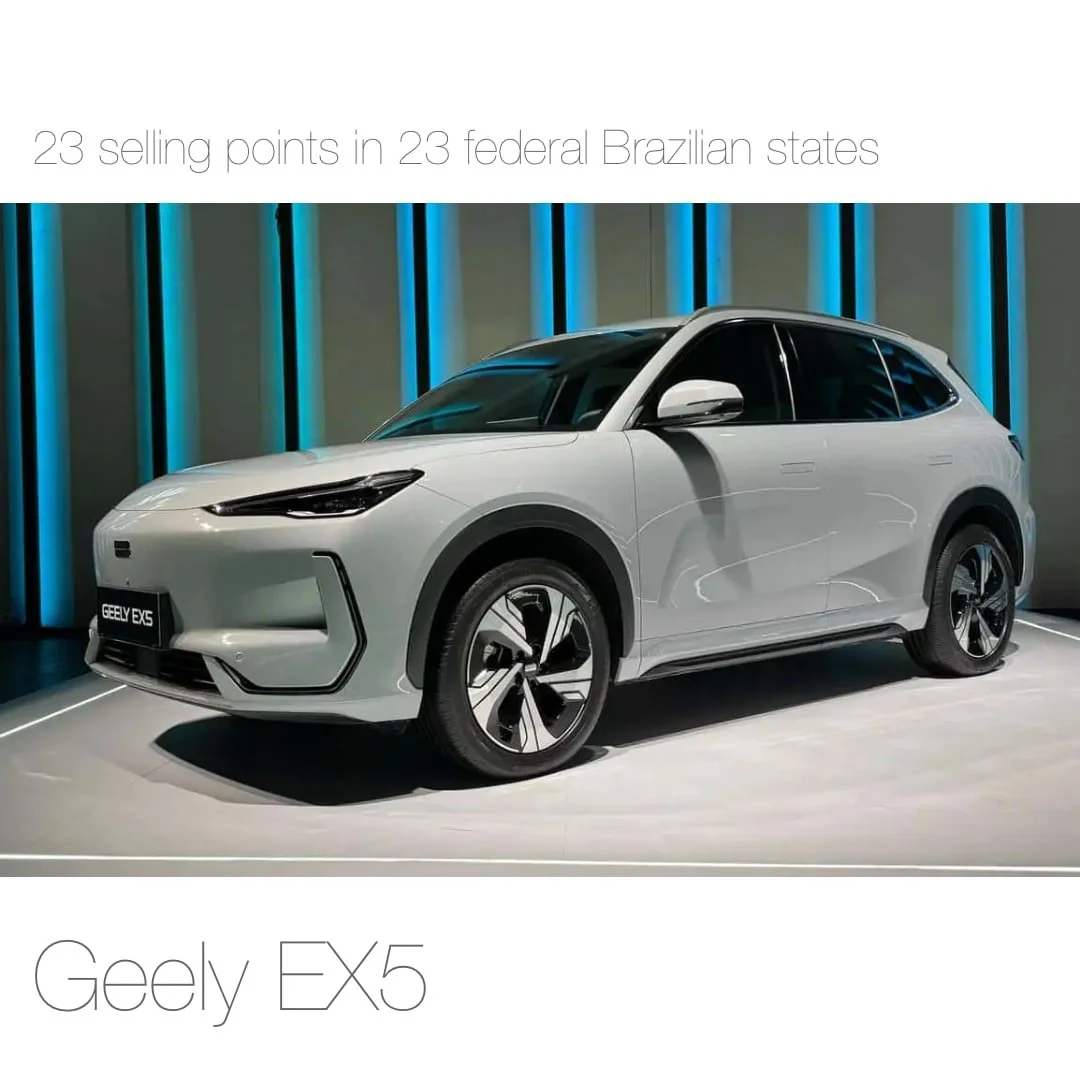

Geely Returns: All-In with Renault and the EX5

Geely, after a previous attempt to enter the Brazilian market, is staging a well-calibrated comeback—this time with backup. Teaming up with Renault, Geely is set to locally produce the EX5 electric SUV at Renault’s factory in Paraná.

The EX5 is no entry-level model:

60 kWh battery, with a projected 400–450 km WLTP range

160 kW motor (218 hp) for smooth, efficient power

Packed with ADAS features: Adaptive Cruise Control, AEB, Lane Keep Assist, and more

Vehicle-to-Load and Vehicle-to-Vehicle charging capabilities

Luxurious cabin design with a 15.4” infotainment screen, panoramic sunroof, and smart interior lighting

Geely will debut with 23 dealerships in 18 cities, aiming for over 100 locations nationwide. The synergy with Renault provides instant scale, access to parts and service infrastructure, and trust—accelerating Geely’s re-entry with strategic precision.

Geely enters the Brazilian market with a premium model

GWM Goes Local: Production Starts at Former Mercedes-Benz Plant

If Denza is the diplomat and Geely the strategist, GWM (Great Wall Motors) is the bold industrialist. In 2025, GWM begins local production at its Iracemápolis plant, acquired from Mercedes-Benz in 2021. With BRL 10 billionearmarked for investment, GWM is playing the long game—and playing it big.

Here’s what’s on the local assembly schedule:

Haval H6: A top-selling hybrid SUV, in four configurations (HEV, PHEV, GT), now made in Brazil

Poer Pickup: A powerful hybrid truck rumored to deliver 408 hp, ready to challenge Toyota and Ford

WEY 07: A luxury plug-in hybrid SUV boasting semi-autonomous driving features and a multi-screen, high-tech interior

GWM isn’t stopping at assembly—it’s aiming for 60% local content by 2026, including potential battery production in Brazil. That’s not just a local play; it’s a regional export strategy.

GWM confirmed the local production of Haval, Way and Poer

Brazil's Role in the Global EV Shift

What do these three brands have in common? A recognition that Brazil is no longer a peripheral market, but a strategic focal point in the global mobility revolution. Each entry is carefully tailored:

Denza brings status and elegance, elevating the electric vehicle to a luxury experience.

Geely, with Renault’s support, champions a pragmatic and scalable approach to electrification.

GWM sets the manufacturing standard, making Brazil a hub for NEV innovation in Latin America.

With consumers hungry for tech, policy shifts favoring sustainability, and infrastructure slowly catching up, the Brazilian EV market is primed for liftoff. These Chinese OEMs aren't just selling cars—they're reshaping the future of transportation in Brazil.

Final Thoughts | Get Ready for the Ride

This triple arrival isn't a coincidence. It’s a calculated, strategic, and irreversible shift. Denza, Geely, and GWM aren’t just new brands—they’re new paradigms. As 2025 kicks into gear, expect more than just new models on the road. Expect competition, innovation, and a renewed sense of direction in how Brazilians move through their cities and beyond.

Fasten your seatbelt, Brazil. The electric future is here—and it’s charging ahead.

Sign up with your email address and smash the subscribe button!

The LatAm Story

Brazilian Executives Leading the Way in Generative AI Adoption!

Comparing several studies and surveys published during the past 12 months, one can tracking an exciting trend that puts Brazil at the forefront of technological innovation: Brazilian executives are demonstrating a significantly higher receptivity to generative AI compared to their global counterparts.

Recent surveys and reports consistently highlight this fascinating divergence. While boardrooms worldwide are still grappling with the implications and integration strategies for generative AI, Brazilian leaders appear to be embracing its potential with remarkable enthusiasm and openness.

Approaching Rio de Janeiro - Santos Dumont City Airport - Rio de Janeiro (RJ) - Brazil

What's Driving This Trend?

Several factors likely contribute to this proactive stance:

A Culture of Adaptability: Brazil has a history of rapid technological adoption and an entrepreneurial spirit that often embraces new solutions to overcome challenges.

Focus on Efficiency and Competitiveness: In a dynamic market, Brazilian businesses are constantly seeking innovative ways to boost productivity, reduce costs, and gain a competitive edge. Generative AI offers compelling solutions in these areas.

Talent Pool and Innovation Hubs: Brazil boasts a growing pool of tech talent and burgeoning innovation hubs, fostering an environment ripe for exploring and implementing cutting-edge technologies.

Addressing Specific Market Needs: Generative AI can offer bespoke solutions for various sectors within Brazil, from optimizing customer service in large consumer markets to streamlining operations in agriculture or manufacturing.

What Does This Mean for the Future?

This heightened receptivity suggests that Brazil could become a key testbed and a leader in the practical application of generative AI across various industries. We can anticipate from our project missions:

Accelerated adoption: Brazilian companies are likely to integrate generative AI tools and solutions at a faster pace, potentially leading to significant operational improvements and new business models.

Increased investment: This positive sentiment could attract more investment in AI research and development within Brazil, further strengthening its position as an innovation hub.

Competitive Advantage: Early and effective adoption of generative AI could give Brazilian businesses a substantial competitive advantage in the global market.

New Opportunities: The rapid integration of AI will undoubtedly create new job roles, skill demands, and entrepreneurial opportunities.

It's an exciting time to observe the Brazilian business landscape as it paves the way for a more AI-driven future. We will continue to monitor these developments closely and bring you the latest insights on how generative AI is transforming industries.

Stay tuned for more updates!

Sign up with your email address to receive news and updates!

From the Newsroom of Industry

Drone Delivery Takes Flight in Curitiba: Correios Pilots Innovative Future

Curitiba, Brazil – The skies above Curitiba are buzzing with a glimpse into the future of logistics, as Correios, the Brazilian postal service, embarks on an innovative pilot program testing drone deliveries. This groundbreaking initiative marks a significant step towards modernizing mail and package delivery in Brazil, potentially revolutionizing how goods reach urban and remote areas alike.

The testing phase is currently underway in specific areas of Curitiba, where Correios is meticulously evaluating the efficacy, safety, and operational viability of unmanned aerial vehicles (UAVs) for last-mile delivery. While details about the exact models of drones being utilized remain under wraps, the focus is clearly on integrating cutting-edge technology to enhance efficiency and reduce delivery times.

This move by Correios aligns with a growing global trend of postal services and logistics companies exploring drone technology. The potential benefits are considerable:

Increased Efficiency: Drones can bypass traffic congestion, delivering packages directly and often more quickly than traditional methods.

Access to Difficult Terrain: UAVs offer a solution for reaching areas that are challenging or costly for ground vehicles to access.

Reduced Environmental Impact: Electric drones offer a more sustainable alternative to fossil fuel-powered delivery vehicles, contributing to greener urban environments.

The Curitiba pilot program is expected to gather crucial data on various aspects, including flight endurance, payload capacity, navigation accuracy, and the integration of drone operations with existing logistical infrastructure. Furthermore, Correios will be keen to assess public perception and address any concerns regarding noise, privacy, and safety.

While widespread drone delivery is still some way off, this pilot program represents a significant stride forward for Correios and for Brazil. It signals a strong commitment to embracing technological advancements to better serve the populace. As the testing progresses, all eyes will be on Curitiba to see how this aerial innovation reshapes the landscape of package delivery in the country.

Type your email, smash the subscribe button and get the next edition in your email inbox!

Short Cuts from Industries

🇧🇷 Brazilian Beef Exports to the U.S. Surge Despite Tariffs

April delivers a juicy surprise for Brazil's meat industry.

Brazilian beef exporters had a standout month in April, shipping an impressive 48,000 metric tons of beef to the United States — a notable figure given the recent enforcement of new 10% import tariffs by the U.S. government.

What’s driving this unexpected boom? A severe cattle shortage in the U.S. has sparked an uptick in demand for imported beef, and Brazil has been quick to fill the gap. Despite trade barriers, American importers turned to Brazil to keep up with domestic needs, highlighting Brazil’s growing role as a key player in the global meat supply chain.

Already the world’s leading beef exporter, Brazil is on track to take the crown as the largest beef producer globally by 2026, surpassing the United States in total output. For industry watchers, this shift marks more than a statistical milestone — it's a sign of how global protein demand, trade policy, and agricultural competitiveness are reshaping food markets worldwide.

As tariffs meet market realities, one thing is clear: Brazil’s beef industry continues to sizzle on the international stage.

🚀 Arca Continental kicks off 2025 with strong momentum!

One of Latin America’s largest Coca-Cola bottlers reported a +10.2% jump in Q1 net profit, reaching MX$4.144B (US$211M).

📈 Sales surged 12.4% YoY to MX$57.039B (US$2.908B), with regional highlights:

🇲🇽 Stable revenue in Mexico

🇺🇸 Over +21% growth in the U.S.

🇪🇨🇦🇷 +25% boost from South America

💰 EBITDA rose 10.2% to MX$10.646B (US$542M), though margins slightly tightened to 18.7%.

🔍 CEO Arturo Gutiérrez: “These results reflect our adaptability, pricing strategy, and top-tier execution. We remain committed to creating value and leading in the communities we serve.”

#LatAmBusiness #CocaCola #EmergingMarkets #Q1Results #Mexico #SouthAmerica #BottlingIndustry #BusinessGrowth #ArcaContinental #FMCG #BizDev

👉 What’s your take on Arca’s regional strategy?

🚨 Big news from Chile's renewable energy front! 🌱⚡️

Grenergy just signed a 15-year green Power Purchase Agreement (PPA) with Codelco, the world’s largest copper producer 🇨🇱🔋. Starting January, GR Power will supply 0.5 TWh of clean energy per year, guaranteeing 24/7 powerto this industrial giant.

The energy will come from Grenergy’s hybrid platform in central Chile, including the 340 MW Monte Águila plantequipped with BESS storage, ensuring consistent green power day and night 🌞🌙.

This game-changing deal adds to Grenergy’s growing list of major PPAs — like the Oasis de Atacama, one of the largest renewable projects on the planet, with 11 GWh of storage and 2 GW of solar capacity ☀️🌍.

CEO David Ruiz de Andrés calls it a "milestone", showcasing Grenergy’s ability to deliver affordable, stable, and clean energy to major offtakers — powered by a strong bet on batteries and innovation 🔋💡.

With 100 projects completed and a growing platform of 4.6 GW solar + 18.3 GWh storage, Grenergy continues to lead Chile’s energy transition. 🚀

#CleanEnergy #PPA #Grenergy #Codelco #Chile #GreenPower #BatteryStorage #Sustainability #CopperMeetsGreen #24x7Energy #EnergyTransition

🚨 Big News from Mexico’s Fintech Scene! 🇲🇽🇧🇷

Brazilian neobank Nubank just got a major green light! The Mexican financial regulator CNBV has granted Nubank’s local unit, Nu Mexico, authorization to move forward with a full banking license. 🏦

This is a major step as Nubank — already boasting 10 million customers in Mexico — shifts from operating as a Sofipo to becoming a full-fledged bank. While final operational approval is still pending, the move positions Nubank to compete directly with big names like Mercado Pago and Revolut, both of whom are eyeing Mexico’s booming neobank market.

📈 The battle for digital banking dominance in Latin America’s second-largest economy just got a lot more exciting.

#Nubank #Fintech #Mexico #DigitalBanking #LatinAmerica #BankingRevolution #NuMexico #Neobank #CNBV #FinancialInclusion

🇧🇷 Brazilian entrepreneur Ricardo Faria has agreed to purchase American egg producer Hillandale Farms for $1.1B.

Faria, the owner of Global Eggs, a Luxembourg-based company which also operates Granja Faria in Brazil, has claimed the purchase was not dominated by the recent avian flu that drove up egg prices in the United States and caused it to boost imports from Brazil. With this said, the move marks the latest in a series of high-profile acquisitions by Brazilian egg companies, representing an international expansion strategy which includes markets in Europe.

🌬️ Repsol Powers Up Its Largest Wind Farm in Chile: A Giant Step in the Company’s Renewable Ambitions

Spanish energy giant Repsol has flipped the switch on its largest wind farm to date in Chile, marking a major milestone in its clean energy strategy. The company officially began producing electricity at Antofagasta Phase 1, a wind farm located in the commune of Taltal in northern Chile, following an investment of nearly €400 million (US$454 million).

With a total installed capacity of 364 MW, the facility is not only Repsol’s biggest renewable energy project in Chile but also ranks among the largest wind farms in the country. This is the first renewable project fully developed by Repsol in Chile, reflecting the company’s evolving focus toward sustainable energy.

Construction of the wind park was completed in just 19 months, and commercial operations are expected to commence in the coming weeks. Once fully operational, Antofagasta Phase 1 will generate approximately 750 GWh annually—enough to power 220,000 households each year.

But Repsol isn’t stopping there. The company has its sights set on Phase 2, which will expand its renewable energy footprint in the Antofagasta region by an additional 450 MW.

Repsol’s entry into Chile's renewable market began with a 50/50 joint venture alongside Grupo Ibereólica Renovables. Together, they operate the Cabo Leones III (188 MW) and Atacama (166 MW) wind farms, both located in the wind-rich Huasco province within the Atacama Desert.

Today, Repsol boasts nearly 4,000 MW of renewable capacity in operation worldwide and manages a global development portfolio of over 60,000 MW across multiple markets.

⚡ Repsol’s renewable revolution is picking up serious wind speed—and Chile is right at the center of the storm.

🇧🇷 Brazilian Private Oil Operator

PetroReconcavo produced an average of 27,700 barrels of oil equivalent (boe) per day in March. The total is 1.56% higher than in February, reflecting the gradual progress of the drilling program, according to the oil company.

At the Potiguar asset, an average of 13.5 thousand barrels of oil equivalent were produced daily, an increase of 1.08% on the level reached in the previous month - 8.7 thousand barrels of oil and 4.7 thousand boe of gas.

Production at the Bahia asset reached 14,200 boe, up 2% on last month. Of the total, 7,800 barrels were oil and 6,500 boe gas.

Stay safe on your project trail! Subscribe with your email!

Ups & Downs

Brazilian Economic Pulse: April 2025 Insights

April once again confirmed Brazil’s strong momentum in industrial exports, closing the month with a surplus of US$ 8.3 billion. This result slightly outpaced March's already robust surplus of US$ 8.1 billion, pushing the year-to-date average to US$ 7.5 billion—a level notably above previous trends. Since 2023, Brazil has maintained a consistent trajectory of expanding export surpluses, positioning the country as an increasingly resilient player in global trade.

Consumer Confidence Rebounds

In a much-needed turn of events, Brazil’s consumer confidence index rose by 4.4 points in April, reaching 87.5 points. This rebound effectively recovers nearly half of the cumulative declines seen over the past four months. According to the Fundação Getulio Vargas (FGV), this uptick is largely driven by a more psychologically balanced assessment of Brazil's real risks and opportunities for 2025. A recalibrated optimism appears to be taking hold, suggesting that both consumers and businesses are beginning to navigate the year with renewed pragmatism.

Steel Imports Brazil

Imports of rolled and flat steel reached 293,000 tons in April 2025. Most worrying are imports of hot-rolled flat steel, which grew by +48% in April. According to the Association of Steel Distributors in Brazil, more than 75% of these intermediate products come from China.

Supermarket Sales in São Paulo

Supermarket sales in the state of São Paulo grew by almost +9% in February 2025 compared to the same period in 2024. At US$ 23 billion, sales reached their highest level since 2008. In 2008, Brazil was in a boom phase. In the first two months of the current year, sales grew by +9.4%.

Brazilian Industry Confidence Index

The Brazilian industry confidence index (ICI), compiled by the FGV, rose by 0.9 points in the period from April 2025 to May 2025. This increase is the highest recorded in the current year. The reasons cited are the steady increase in industrial demand and plans to expand production.

Sales in the Brazilian Mechanical Engineering Sector

In April 2025, Brazil's national mechanical engineering sector recorded sales of US$ 4.5 billion, representing an increase of +2.5% compared to April of the same year. Compared to the same period in April 2024, an increase of +9% was recorded. The cumulative growth between January and April 2025 was +13.4% compared to the same period last year.

Agricultural Machinery: A Mixed Bag

The agricultural sector presented a nuanced picture. Sales of agricultural tractors in March amounted to 3,300 units, marking a -11% decline compared to March 2024 and a -12.8% drop from February 2025. However, it’s not all downbeat: the first quarter of 2025 recorded a significant +21.6% increase in tractor sales compared to the same period in 2024. This underscores a front-loaded investment dynamic, possibly linked to shifts in agricultural planning and financing cycles.

M&A Market Hits a Low Point

The mergers and acquisitions (M&A) market, however, has entered choppy waters. The first trimester of 2025 saw the worst quarterly result since 2020. The dominant headwind? Global uncertainty, largely attributed to the new administration of Donald Trump in the United States. While Brazil's own fiscal concerns persist, they have been decisively eclipsed by the unpredictability radiating from Washington.

At iMB.Solutions, we are also feeling the effects of this turbulence. Post-merger integration projects—which typically follow successful M&A deals—have largely been put on hold or suspended altogether. This wait-and-see posture reflects a broader, global hesitancy that may persist until greater policy clarity emerges from the U.S.

Service Sector Confidence Slips Again

Finally, the services sector confidence index took another hit, dropping by 2.5 points from March to April and landing at 90.4 points—its lowest level since May 2021. Despite a brief resurgence in February, sentiment has once again deteriorated. This decline signals mounting concerns within Brazil's vital services economy, which continues to wrestle with macroeconomic uncertainties both at home and abroad.

Outlook

While Brazil’s industrial exports remain a stronghold and consumer confidence shows signs of recovery, sectoral disparities persist. The agricultural machinery market reveals underlying resilience despite recent dips, whereas the M&A and services sectors illustrate the pervasive impact of global volatility. For business leaders and strategists, this is a moment to stay agile, monitor international developments closely, and leverage Brazil's underlying strengths while navigating the headwinds of 2025.

One stop subscription. If you don´t like it, unsubscribe with one smash!

News from iMB.Solutions

🌍 Global Project Missions in Flux: High Demand Meets Strategic Shifts

The international market for new project missions is navigating choppy geopolitical waters—but it’s far from stagnant. In fact, demand for project support remains robust across the board. Companies from Brazil and Europe, in particular, are actively pursuing external expertise to drive transformation, growth, and innovation.

However, there’s a distinct regional divide. While North American firms are currently adopting a pronounced wait-and-see stance, and the Mexican project pipeline has temporarily dried up, momentum continues to build in other key areas.

📉 From Long-Term to Modular: Project Structures Are Evolving

A clear trend continues to take shape in the aftermath of the pandemic: project missions are becoming more agile. The dominant model now favors shorter assignments—typically ranging between five and eight months—or missions broken down into discrete, result-oriented packages. This reflects the growing need for speed, flexibility, and targeted impact in today’s volatile environment.

📌 Where Demand is Rising

We’re observing particularly strong demand in the following segments:

Brazilian mid-sized family businesses navigating succession scenarios, with a growing urgency to professionalize operations and attract strategic investors.

Brazilian exporters seeking experienced support to develop and penetrate new international markets.

Brazil-based innovators, including startups exploring new business models to remain competitive and resilient in fast-changing markets.

European automotive suppliers realigning local value chains to deepen integration between Brazilian and Mexican operations—driven by regionalization, resilience, and ESG mandates.

Generative AI implementation, particularly the deployment of internal small language models (SLMs) to unlock efficiency gains and knowledge capture within companies.

Despite global uncertainty, the appetite for transformation remains strong. The opportunity lies in embracing agility—both in the structure of project engagements and in the strategic vision behind them.

Get Out

Capturing São Paulo by Night: A Unique Photo Walk with International Business Travelers

In May, after a long hiatus, we were thrilled to revive our tradition of organizing photo walks — an experience that becomes especially enriching when it brings together a diverse group of photography enthusiasts from around the world. This time was no exception, and what made it truly remarkable was the unique composition of the group: not expats, but genuine business travelers.

Among the participants were executives visiting Brazil to explore potential new project missions with iMB.Solutions, as well as several international guests we had the pleasure of meeting during an event hosted by a leading global consulting firm in São Paulo. We actively engaged in panel discussions and podium sessions at this event, exchanging insights on business trends and cross-cultural collaborations.

One of the most fascinating aspects of these walks is witnessing how a simple stroll through the vibrant center of São Paulo can transform visitors' perceptions of the city. The metropolis, with its rich layers of history, architecture, and street life, reveals itself in unexpected ways — especially when experienced on foot and through the lens of a camera.

This time, we elevated the experience by organizing a night-time photo walk, adding an extra dimension to the already impressive urban landscape. The interplay of lights and shadows, the pulse of the city after dark, and the spontaneous encounters along the way left a lasting impression on all participants.

Once again, the power of visual exploration proved to be a compelling way to connect cultures, spark conversations, and offer fresh perspectives — not just on São Paulo, but on the very nature of international business travel itself.

We look forward to organizing more of these inspiring walks in the future, continuing to blend creativity, culture, and commerce in one of the world’s most dynamic cities.

Contact

click on the image and access the iMB.Solutions Contact Hub

You want to subscribe to the newsletter? OK, take your smartphone and scan the QR code!

Discover What Matters Most to You—Backed by 140+ Project Missions!

Curious about the impact of our insights at iMB.Solutions? We put our articles, blogs, and case studies to the test—running three independent AI-driven queries with Perplexity, Google Gemini, and Mistral. The result? A powerful keyword cloud reflecting the topics that truly resonate.

Do you see yourself in these trends? Let’s connect and explore how our expertise—shaped by 140+ project missions over two decades—can drive your success.

- Brazil

- business development

- USMCA

- Mexico

- Latin America

- project management

- Argentina

- South America

- nearshoring to USMCA

- Argentina debt crisis

- Argentina inflation rates

- business transformation

- Economic recession in Argentina

- B2B

- Argentina insolvency

- business model

- Fiscal policies Argentina

- Bolivia

- digital creativity

- Analog-Digital Integration

- digital transformation in family businesses

- Argentina peso depreciation

- Brazil business opportunities

- Bolivia Mining Projects

- Argentina economy

- Mexico Supply Chain

- cost efficiency Mexico

- economic potential Mexico

- Europe

- B2C

- Argentina economic challenges

- Brazil economy

- Automotive Industry

- Chile mining market

- Brazil market entry

- USMCA free trade agreement

- Brazilian economic resilience

- digitization

- Mexico as a production location

- NAFTA

- Digital Business

- Digital Currency

- Bolivia lithium industry

- Brazilian companies

- Bolivia mining industry

- Manufacturing in Mexico

- Digital Environment

- Brazil market potential

- digitalization in mechanical engineering

- Brazil as a strategic market

- Chile

- oil and gas Industry

- Brazilian economic forecasting

- Venezuela

- Brazilian business analysts

- Newsletter

- Roundup

- reorganisation

- Colombia

- GreyRhino newsletter

- Grey Rhino

- iMB

- iMBSolutions

- consumer goods

- DACH

- mechanical engineering

- Peru

- mining

- Mercosur

- Mercosul

- project tools

- business plan

- transformation

- restructuring

- Interim management

- Generative AI

- interim manager

- leadership

- business reorganization projects

- Organizational Change Management

- business case

- Microsoft Dynamics 365

- Project Management

- Brasil

- Leadership in change

- business agility

- Argentine economy

- Javier Milei

- Strategic scenarios

- production facilities in Mexico

- Generative AI in business

- USA

- crise management

- reorganization

- franchise restaurants

- lean startup

- data analysis

- OneBizTutor

- risk management

- Data Security