GreyRhino Newsletter Edition September 2025

Discover the GreyRhino Newsletter by iMB.Solutions!

Stay ahead of the curve with the GreyRhino newsletter, your go-to source for insightful analysis and expert commentary straight out of the project missions. Curated by iMB.Solutions, this newsletter dives deep into the "grey rhino" events—highly probable, high-impact threats that we often overlook.

Why Subscribe?

Expert Insights: Gain access to Frank P. Neuhaus's unique perspectives and in-depth analysis on global risks and opportunities.

Timely Updates: Stay informed with the latest developments and trends that could impact your business and personal life.

Actionable Advice: Learn practical strategies to navigate and mitigate risks, ensuring you're always prepared for what's next.

Join a community of forward-thinking professionals who are committed to staying informed and proactive. Don't miss out on the valuable knowledge and insights shared in the GreyRhino newsletter.

📥 Subscribe now on iMB.Solutions webpage and turn potential threats into opportunities!

Sign up with your email address to receive news and update!

Prime Story

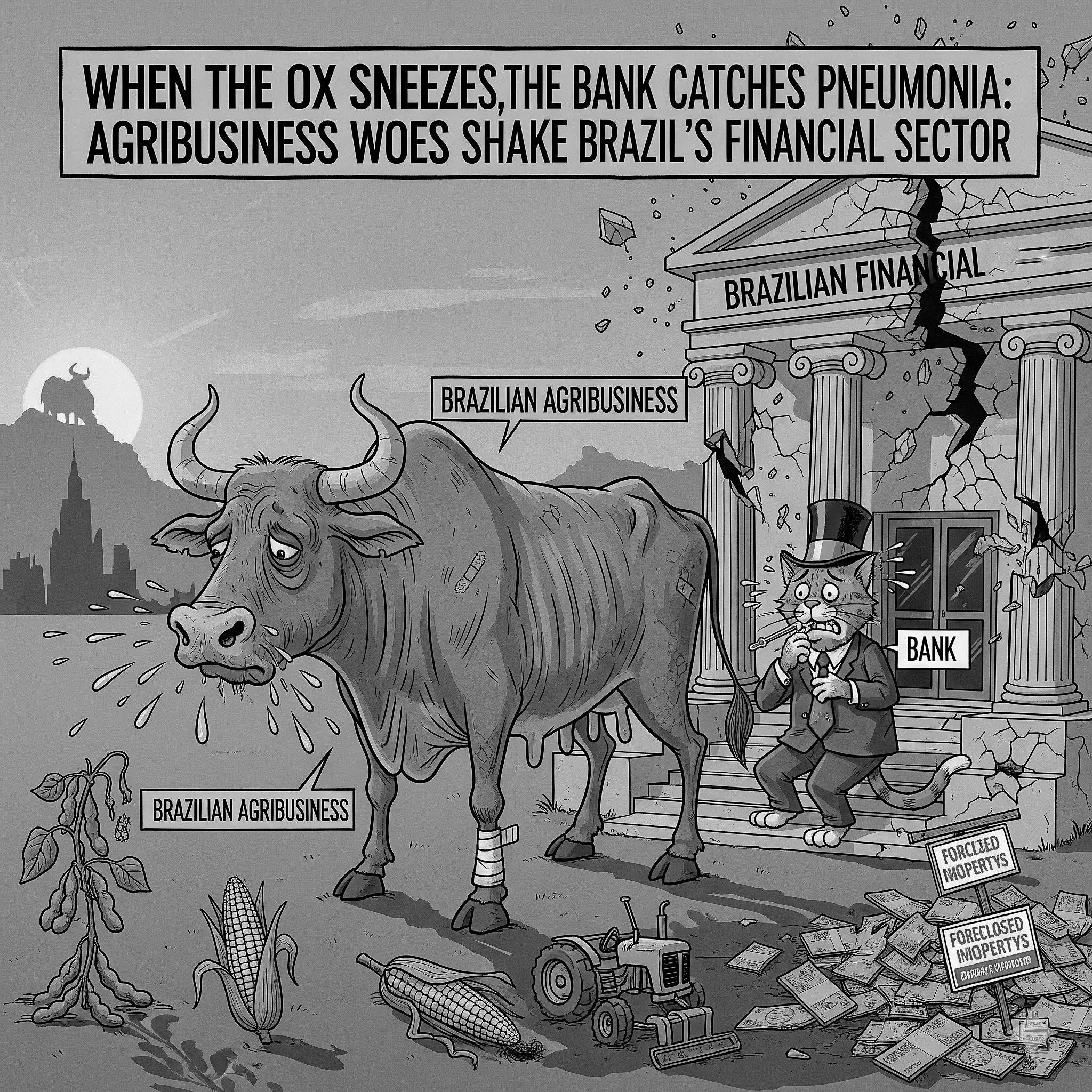

When the Ox Sneezes, the Bank Catches Pneumonia: Agribusiness Woes Shake Brazil’s Financial Sector

Welcome to this month’s deep dive into the pulse of Brazil’s economy, where the tremors in agribusiness are sending shockwaves through the banking sector. Buckle up—it’s a bumpy ride, but we’ll navigate it with clarity, a touch of humor, and a proactive lens to uncover solutions. Let’s explore why Banco do Brasil’s balance sheet is coughing, what’s driving defaults in agriculture, and how the industry is adapting to this stormy season.

source: generated by Grok - https://grok.com/chat/9a581fb9-3b5b-4bca-8627-5cce2da72952

Banco do Brasil’s Tough Harvest: Profits Plummet, Defaults Soar

Picture this: when Brazil’s fields sneeze, Banco do Brasil (BB) reaches for the tissues. In Q2 2025, BB’s adjusted net profit took a 60.2% nosedive year-over-year, landing at R$3.8 billion—well below consensus expectations. Return on Equity (ROE) slumped to 8.4%, and the bank trimmed its 2025 profit guidance to R$21–25 billion while slashing its payout ratio to 30%. The stock? Let’s just say it’s been on a steeper slide than a soybean price chart.

Why the rough patch? Two culprits stand out: rising defaults in agriculture and tighter regulatory provisioning rules. Rural producer defaults hit 7.9% in Q1 2025, up 0.9 percentage points from Q1 2024, driven by a “hangover” from cheap credit binges in 2020–2021. With agriculture powering 49.5% of Brazil’s exports in the first half of 2025, the sector’s volatility is no small matter. When commodity prices dip or the weather misbehaves, banks like BB scramble to restock their financial first aid kits—think provisions for doubtful debts (PDD) as gauze and morphine.

Proactive Take: BB isn’t doomed—it’s recalibrating. The bank is shifting to faster-executing guarantees like fiduciary alienation, ramping up legal action against “predatory” judicial reorganizations (RJs), and tightening collection processes. Could this be the start of a leaner, meaner BB? Time to keep an eye on their next moves.

The Agribusiness Hangover: Defaults and Judicial Reorganizations

Agribusiness isn’t just sneezing—it’s battling a full-blown fever. Despite projections of record corn and soybean harvests in 2025, producers are grappling with a perfect storm: falling commodity prices, high leverage from low-rate loans, and new provisioning rules under Central Bank Resolution 4,966, which emphasizes “expected loss.” Add to that the uncertainty of U.S. tariffs on Brazilian goods, and you’ve got a recipe for financial heartburn.

BB, with a commanding 50% market share in agricultural lending, is feeling the heat most acutely. Its rural credit portfolio stands at R$404.9 billion, with a delinquency rate soaring to 3.94% (up from 2.45% a year ago). About 20,000 customers are in default, 74% of whom were squeaky-clean borrowers until 2023. The Midwest and South, particularly soybean, corn, and cattle farmers, account for 52% of these defaults. Meanwhile, 808 clients in Rio de Janeiro, with R$5.4 billion in loans, are leveraging judicial reorganizations—prompting BB’s President Tarciana Medeiros to call out “predatory litigation” by law firms.

Other banks aren’t immune. Santander’s R$22.4 billion agribusiness portfolio is bracing for prolonged default challenges, though CEO Mario Leão remains optimistic about a cyclical rebound. Itaú, with a R$130 billion portfolio, boasts a lower RJ exposure (just 5%) thanks to active portfolio management and diversified crops. Bradesco’s Marcelo Noronha echoes this confidence, citing Brazil’s competitive edge and their R$79.4 billion portfolio’s robust guarantees. Cooperatives like Sicredi note regional variations in defaults but stress the need for vigilant management.

Innovative Angle: Could banks and cooperatives collaborate on a risk-sharing model to weather commodity cycles? Imagine a consortium pooling resources to hedge against price volatility or a digital platform to streamline RJ screenings. It’s time to think beyond coffee chats with clients.

M&A Slows, but Opportunities Emerge

The agribusiness M&A scene is cooling faster than a Brazilian winter. In the first half of 2025, deal activity dropped ~30% compared to 2024, reflecting caution amid commodity stress. Buyers are picky, favoring deals with deleveraging potential or price-hedging mechanisms. The focus is shifting from growth to “surgery”—think carve-outs of distressed assets, tactical consolidation in fertilizers, logistics, or processing, and deals with cash protection. Valuations now lean on conservative DCF models, incorporating commodity price strips, maintenance covenants, and post-cycle EBITDA earn-outs. No one’s buying PowerPoint dreams anymore.

Solution-Oriented Insight: This slowdown could be a blessing in disguise. Distressed assets are ripe for strategic buyers who can optimize operations or integrate vertically. Banks could play matchmaker, facilitating deals that stabilize rural producers while diversifying their own exposure.

The Big Picture: Commodity Risk Isn’t the Villain—It’s the Star

Here’s the crux: agriculture didn’t “bring down” Banco do Brasil—it’s simply exposing the risks of a commodity-heavy economy. Brazil’s reliance on agriculture (49.5% of exports) means banks must price volatility like storm chasers, not utility managers. The 25/26 Harvest Plan, at R$594.4 billion, offers a modest 1.69% increase over last year, but high interest rates and limited subsidies spell trouble for indebted producers. With defaults likely to stay elevated through Q3, banks are doubling down on risk management.

Motivating Spin: This is Brazil’s chance to innovate. Banks could pioneer commodity-linked financial products, like revenue insurance tied to price indices, or partner with fintechs to offer real-time credit monitoring. Producers could adopt precision agriculture to boost margins, while policymakers could rethink subsidy structures to cushion volatility. The ox may be sneezing, but with smart moves, the bank won’t stay bedridden.

What’s Next?

The agricultural cycle will turn—Brazil’s fields are too resilient not to. But for now, banks, producers, and policymakers must act fast. BB’s shift to tougher guarantees and legal action is a start, but the sector needs bolder solutions: diversified portfolios, smarter hedging, and maybe even a blockchain-based credit registry to flag RJ abuse. Let’s keep the conversation going—share your thoughts on X or grok.com. Together, we can turn this sneeze into a springboard for growth.—analyzed by OneBizTutor®

Sign up with your email address and smash the subscribe button!

The LatAm Story

Mexico Rules Out Free Trade Agreement with Brazil

In a recent statement, Mexico's Economy Secretary Marcelo Ebrard announced that Mexico has decided against pursuing a free trade agreement with Brazil, marking another chapter in the complex trade relationship between Latin America's two largest economies. Despite multiple attempts to strengthen economic ties, both nations have faced challenges in aligning their trade objectives.

Observers note that the primary obstacle lies in the competitive nature of their economies. Unlike complementary markets that naturally support mutual growth, Mexico and Brazil often find themselves vying for dominance in similar sectors, which has hindered deeper trade integration.

However, cooperation persists in specific areas. The two countries maintain an economic complementarity agreement in the automotive sector, fostering targeted collaboration. Additionally, Mexico is taking steps to expand trade in other areas, with authorities announcing plans to audit 14 Brazilian meatpacking plants in September. This initiative aims to authorize these facilities to export meat to Mexico, potentially opening new avenues for bilateral trade.

While a comprehensive free trade agreement remains off the table for now, these incremental steps signal that both nations are still exploring ways to navigate their competitive yet interconnected economic landscapes. Stay tuned for updates as Mexico and Brazil continue to shape their trade relationship.

U.S. Resumes Venezuelan Oil Imports Under New Chevron License

The United States has officially resumed imports of Venezuelan crude oil, marking a significant shift after a three-month hiatus. Two Chevron-chartered tankers, the Mediterranean Voyager and Canopus Voyager, loaded with Venezuelan Boscan and Hamaca crudes, arrived in U.S. waters by end of August. This milestone follows the U.S. Treasury Department’s issuance of a restricted license to Chevron last month, allowing the company to operate in Venezuela and export its oil.

The tankers, which loaded their cargoes earlier this month after negotiations with Venezuela’s state-owned PDVSA (Chevron’s partner in several joint ventures), are set to discharge at Port Arthur, Texas, and New Orleans, Louisiana. Two additional Chevron cargoes are also en route to the U.S., signaling a steady resumption of oil flow. Chevron’s CEO, Mike Wirth, confirmed that limited volumes of Venezuelan oil would resume flowing to the U.S. in August, and it seems the plan is right on track!

This development comes after a challenging period for Chevron, which faced disruptions in April when PDVSA canceled several scheduled cargoes due to payment issues tied to U.S. sanctions. In the first quarter of this year, Chevron exported an impressive 252,000 barrels per day of Venezuelan crude to the U.S., processing some at its own refineries and supplying the rest to independent refiners like Valero Energy and PBF Energy.

Venezuela, however, continues to voice strong opposition to U.S. sanctions, labeling them as an “economic war” against the nation. The resumption of oil exports under this new license could signal a pragmatic step forward in navigating these complex geopolitical dynamics, potentially stabilizing energy supplies and fostering economic opportunities.

Verification of Key Points—analyzed by OneBizTutor®; Sep. 03, 2025 - 02:32PM

Resumption of U.S. Imports of Venezuelan Oil:

Confirmed: Multiple sources, including Reuters, MarineLink, and Oil & Gas 360, report that two Chevron-chartered tankers, the Mediterranean Voyager and Canopus Voyager, carrying Venezuelan crude reached U.S. waters on August 21, 2025, marking the first U.S. imports of Venezuelan oil after a three-month pause. This aligns with your statement.

Details of the Tankers and Cargo:

Confirmed: The tankers loaded Venezuelan Boscan and Hamaca crudes earlier in August 2025 after negotiations with PDVSA, Chevron’s partner in several joint ventures. They are scheduled to discharge at Port Arthur, Texas, and New Orleans, Louisiana. Additionally, two more Chevron cargoes are en route to the U.S., supporting the claim of a steady resumption.

U.S. Treasury Department’s Restricted License:

Confirmed: The U.S. Treasury Department issued a restricted license to Chevron in July 2025, allowing the company to operate in Venezuela and export oil after a three-month hiatus due to stricter U.S. policies toward sanctioned Venezuela. This license was granted with the condition that no oil proceeds directly benefit the Maduro administration.

Chevron’s CEO Statement:

Confirmed: Chevron CEO Mike Wirth stated earlier in August 2025 that Venezuelan oil exports to the U.S. would resume in limited volumes. This is consistent with the reported arrival of the tankers and the ongoing shipments.

Previous Disruptions in April 2025:

Confirmed: Chevron faced disruptions in April 2025 when PDVSA canceled several cargoes due to payment issues linked to U.S. sanctions. This caused a halt in Chevron’s access to Venezuelan crude until the new license was issued.

Chevron’s Export Volume in Q1 2025:

Confirmed: Chevron exported approximately 252,000 barrels per day of Venezuelan oil to the U.S. in the first quarter of 2025, processing some at its refineries and supplying the rest to independent refiners like Valero Energy and PBF Energy. This figure is consistently reported across sources.

Venezuela’s Stance on U.S. Sanctions:

Confirmed: The Venezuelan government, under President Nicolás Maduro, has consistently rejected U.S. sanctions, describing them as an “economic war” against the nation. This position is reiterated in multiple reports, aligning with your statement.

Potential Discrepancies or Additional Context

While the information is largely accurate, there are a few nuances and additional details worth noting to ensure a comprehensive understanding:

Geopolitical Context and License Restrictions: The new license is described as “restricted,” with explicit conditions that no oil proceeds can be transferred to the Maduro administration. This reflects ongoing U.S. efforts to pressure Venezuela on democratic reforms and migrant repatriation, as seen in earlier actions by the Trump administration to revoke Chevron’s license in March 2025 (with a wind-down period until April 3, 2025). The reinstatement in July 2025 suggests a pragmatic shift, possibly driven by U.S. energy security needs or diplomatic negotiations, though sources do not explicitly confirm the exact motivations.

Inconsistency in Political Attribution: One source attributes the new license to the Trump administration, which could be confusing since the license was revoked earlier in 2025 under Trump’s directive. This may reflect a policy reversal or a misattribution, as other sources do not specify the administration responsible for the July 2025 license. Given the timeline, it’s likely a decision influenced by evolving U.S. foreign policy priorities.

Broader Implications: The resumption has sparked debate about U.S. consistency in enforcing sanctions, as some analysts note that the U.S. criticizes countries like India for importing Russian oil while resuming Venezuelan imports. This adds a layer of complexity to the geopolitical narrative, suggesting energy security may override strict sanction enforcement in certain cases.

Critical Perspective

While the sources confirm the resumption of oil imports, it’s worth critically examining the broader context. The U.S. decision to allow Chevron to resume operations may reflect a balancing act between sanctioning Venezuela’s regime and addressing domestic energy needs, especially since Venezuelan crude accounted for 3.5% of U.S. crude imports in 2024. The restriction on funds reaching Maduro’s government aims to limit financial support to the regime, but the joint ventures with PDVSA inevitably channel some revenue to Venezuela, raising questions about the effectiveness of this approach. Additionally, the earlier cancellation of Chevron’s license in March 2025 and its quick reinstatement by July suggest policy volatility, which could impact long-term energy stability and investor confidence.

Solution-Oriented Outlook

This resumption is a promising step toward stabilizing U.S. energy supplies and fostering economic opportunities for Chevron and its partners. To maximize the benefits while navigating geopolitical tensions, stakeholders could:

Enhance Transparency: The U.S. Treasury could clarify the terms of the restricted license to address concerns about consistency in sanction enforcement, boosting public and international trust.

Diversify Energy Sources: U.S. refiners like Valero and PBF Energy could explore alternative heavy crude sources (e.g., from Colombia or Guyana) to reduce reliance on Venezuelan oil and mitigate future disruptions.

Strengthen Diplomacy: Engaging Venezuela in constructive dialogue on democratic reforms could pave the way for more stable trade relations, reducing the need for abrupt policy shifts.

Humorous Note

Looks like Venezuelan oil is making a grand comeback to U.S. shores, like a long-lost friend showing up with a tanker full of crude! Let’s hope these tankers don’t get stuck in traffic at Port Arthur or New Orleans—imagine the headlines: “Oil Tankers Cause Crude Congestion!” 😄

Conclusion

The information you provided is confirmed by multiple reputable sources, with minor nuances regarding the political context and long-term implications. The resumption of Venezuelan oil imports under Chevron’s new license is a significant development, reflecting a pragmatic approach to energy security amid complex sanctions. By staying proactive and exploring diversified energy strategies, the U.S. can turn this opportunity into a win for both economic stability and geopolitical progress. If you’d like me to dig deeper into any aspect—say, the impact on U.S. gasoline prices or Venezuela’s economy—just let me know, and I’ll dive in with gusto!—OneBizTutor®

Sign up with your email address to receive news and updates!

From the Newsroom of Industry

WEG Unveils Game-Changing Wemob HPC Station for Electric Vehicles

Get ready to charge into the future with WEG’s latest innovation, the Wemob Emob Station High Power Charging (HPC)! This powerhouse of a charging station is turning heads with its jaw-dropping 640 kW of power and the ability to recharge up to four electric vehicles simultaneously. In Brazil, where most ultra-fast chargers max out at 350 kW, the Wemob HPC is setting a new standard for speed and efficiency in electric vehicle (EV) charging.

A Smarter Way to Power Up

WEG, a leader in electrical and electronic equipment, has engineered the Wemob HPC with cutting-edge technology to make charging faster, smarter, and more flexible. Unlike traditional charging stations that integrate power modules directly into the totem, the Wemob HPC takes a revolutionary approach. It features two totems paired with a modular power cabin, centralizing power modules into blocks for optimized energy delivery.

This innovative setup ensures that energy is distributed efficiently to each connected vehicle, dynamically reallocating power to new vehicles without slowing down those already charging. Whether you’re in a rush or sharing the station, the Wemob HPC keeps things moving smoothly.

Global Compatibility, Local Impact

The Wemob HPC is designed to work seamlessly worldwide, supporting the four major global charging standards: CCS-1, CCS-2, NACS, and Chademo. This versatility makes it a game-changer for EV drivers, ensuring compatibility no matter where you’re charging.

Why It Matters

With its unmatched power, multi-vehicle capacity, and intelligent energy management, the Wemob HPC is poised to accelerate the adoption of electric vehicles in Brazil and beyond. WEG’s forward-thinking design not only meets today’s demands but also paves the way for a more sustainable, electrified future.

Stay charged, stay motivated, and keep an eye on WEG as they continue to power the EV revolution!

Raízen Kicks Off Bidding for Argentina Assets: A Strategic Move in Renewable Energy

Dear Readers,

get ready for a blockbuster deal in the renewable energy sector! Raízen, the dynamic renewable energy arm of the Cosan Group, is stirring up excitement by opening the floor for non-binding bids on its Argentina assets. This bold move, valued at an eye-popping US$15 billion, is drawing attention from commodity trading giants eager to seize this opportunity, as reported by Coluna. Buckle up, because this deal is poised to reshape the energy landscape in Argentina!

A Strategic Pivot with Global Interest

Raízen’s Argentina portfolio is a powerhouse, featuring the country’s second-largest refinery, over 1,000 gas stations, a lubricant factory, three land terminals, two airport supply bases, and valuable gas assets. Acquired from Shell in 2018, with the refinery alone valued at US$1 billion at the time, these assets are a goldmine of economic potential. While Raízen previously explored a deal with Saudi Arabia’s state oil giant, Saudi Aramco, those talks didn’t pan out. Now, Raízen is casting a wider net, inviting trading companies to join the bidding frenzy.

Among the rumored frontrunners? None other than Trafigura, a heavyweight in commodity trading, signaling serious interest in this high-stakes opportunity. With Argentina’s legislative elections looming in October, the process might face a slight delay, but don’t worry—Raízen’s assets are considered economically robust, ready to thrive even in a turbulent market.

Why Sell? A Focus on Synergy and Stability

Sources close to Cosan reveal that Raízen is still weighing its options, but the Argentina operation is seen as a high-risk venture with limited synergy to Raízen’s core fuel production and distribution business in Brazil. By potentially divesting these assets, Raízen is sharpening its focus on its Brazilian stronghold while exploring new ways to maximize value and drive innovation in the renewable energy space.

What’s Next?

This deal is a thrilling chapter in Raízen’s journey to redefine the energy sector. As bids roll in and the market watches closely, we’re excited to see how this strategic move unfolds. Will Trafigura or another trading titan claim this prize? Stay tuned for updates as Raízen continues to innovate and lead in the renewable energy revolution!

Keep energized,

The iMB ARG Team🇦🇷

Type your email, smash the subscribe button and get the next edition in your email inbox!

Short Cuts from Industries

Brazilian Fintechs Surge onto the Global Stage

Brazilian fintechs are breaking borders and making waves worldwide, showcasing the vibrant innovation of Brazil’s financial ecosystem. According to the Brazilian Fintech Association (ABFintechs), representing 750 trailblazing companies, the share of Brazilian fintechs operating abroad has skyrocketed from a modest 2% in 2022 to an impressive 4.1% in 2025. This isn’t just growth—it’s a global revolution!

Why the World Can’t Resist Brazilian Fintechs

Diego Perez, president of ABFintechs, attributes this meteoric rise to a maturing financial ecosystem and strategic international partnerships. “The United States, Mexico, and Colombia are prime destinations for our fintechs to plant their flags,” Perez says. These markets are not just opportunities—they’re launchpads for Brazilian ingenuity.

Take Monkey, a receivables anticipation fintech founded in 2016. Since kicking off its international journey in Chile in 2021, Monkey has leveraged cultural proximity and a familiar regulatory framework to fuel its expansion. CEO Gustavo Muller shares the bold vision: “We’re eyeing the U.S. and Mexico this year, with Colombia and Peru on the horizon for 2026.” Monkey’s strategy? Build on Latin America’s established networks and partner with local experts. Currently, international operations account for 10% of Monkey’s revenue, but Muller’s got his sights set on hitting 25% by 2026. With 12,000 to 15,000 invoices processed daily and clients like Petrobras and Suzano, Monkey’s global ambition is backed by serious firepower.

Ebanx: Connecting the World, One Payment at a Time

Then there’s Ebanx, a payment platform that’s been a global player since its inception in 2012. Connecting giants like Uber and Amazon to consumers, Ebanx operates in over 20 countries, from South Africa to India. In 2024, a whopping 50.7% of its payment volume came from international markets, up from 42.9% in 2023. Product director Sebastian Fantini credits this growth to expansions in Latin America, with a 6% increase in Colombia and a 10% surge in Mexico. Ebanx’s secret sauce? Offering over 200 payment methods, including India’s wildly popular UPI AutoPay.

But it’s not all smooth sailing. Fantini highlights the challenge of market fragmentation: “Each country has its own payment ecosystem—different regulations, consumer preferences, and tech infrastructure.” In Kenya, for instance, mobile money dominates 48% of e-commerce, while Nigeria leans on bank transfers and cards. Ebanx’s solution? Boots on the ground. With dedicated teams in 16 countries, they’re building trust and navigating local nuances like pros.

FitBank and BlockBR: Pioneering New Frontiers

FitBank, a payment services tech provider, is also charging toward global markets. Since starting its expansion in Mexico and Guatemala in 2024, partner Alejandro Vollbrechthausen has his eyes on Central America by 2026. FitBank’s digital wallets are already integrated with three major Guatemalan banks, proving that strategic partnerships are key to cracking new markets.

Meanwhile, BlockBR Digital Assets, a tokenization specialist, is tackling regulatory hurdles head-on. Operating in the U.S. and eyeing Uruguay and Portugal, CEO Cássio Krupinsk emphasizes the importance of local legal expertise. “Regulatory frameworks vary wildly between markets,” he notes. By partnering with law firms, BlockBR ensures its global contracts are rock-solid.

The Road Ahead: Challenges and Opportunities

The journey isn’t without its bumps. From fragmented markets to the complexities of building trust abroad, Brazilian fintechs are tackling challenges with bold strategies. Hiring local talent, forging partnerships, and diving deep into market nuances are just a few ways these companies are paving the way for success.

So, what’s the takeaway? Brazilian fintechs are not just playing the global game—they’re rewriting the rules. With innovation, resilience, and a knack for collaboration, they’re proving that Brazil’s financial future is bright, borderless, and brimming with potential. Stay tuned, because these trailblazers are just getting started!

Brazil’s Ethanol Boom: Corn Steps Up as Sugarcane Shines

Welcome to this month’s Biofuel Bulletin, written by OneBizTutor®, where we dive into the exciting developments fueling Brazil’s ethanol industry! Buckle up, because the Brazilian market for corn-based ethanol has just surged by an impressive 20%, catapulting the country to the position of the world’s second-largest producer of this biofuel. While sugarcane remains the reigning champion of ethanol production in Brazil, corn is making a bold entrance, and we’re here to break down what this means, why it’s happening, and how sugarcane continues to hold its crown.

Corn Ethanol: The Rising Star

Brazil’s ethanol industry is no stranger to growth, but the recent 20% spike in corn-based ethanol production is turning heads. In the 2024/25 season, corn ethanol output reached an estimated 8.2 billion liters, accounting for 22% of Brazil’s total ethanol production. This is a massive leap from just 140 million liters in the 2015/16 season. The Center-West region, particularly states like Mato Grosso, Goiás, and Mato Grosso do Sul, is leading the charge, with 25 operational corn ethanol plants and 15 more under construction. Why the sudden love for corn? It’s all about economics and logistics.

Corn offers some unique advantages for ethanol production in Brazil. Unlike sugarcane, which has a limited growing season and starts fermenting as soon as it’s cut, corn can be stored and processed year-round. This flexibility allows ethanol plants to operate continuously, maximizing output. Plus, falling corn prices—down 12.5% in 2025 according to the Cepea/Esalq corn benchmark—have boosted profit margins, making corn ethanol a lucrative venture. The by-product, dried distillers’ grain (DDG), is another win, serving as a high-protein animal feed that competes with pricier soybean meal.

But it’s not just about economics. Brazil’s robust agricultural sector, now the world’s top corn exporter, has created a surplus of corn, especially in the Center-West. Rather than exporting it all, producers are finding it more cost-effective to process corn locally into ethanol, especially in regions far from sugarcane fields. New investments, like São Martinho’s R$1.1 billion corn ethanol plant and Grupo Potencial’s R$2 billion project, are fueling this growth, often backed by subsidized loans from the Brazilian Development Bank’s Climate Fund.

Sugarcane: The Undisputed King

While corn ethanol is stealing some of the spotlight, sugarcane-based ethanol remains Brazil’s biofuel backbone, producing a steady 28 billion liters annually. Why does sugarcane continue to dominate? It’s all about efficiency and sustainability. Sugarcane ethanol boasts an energy balance seven times higher than corn ethanol, meaning it generates significantly more energy relative to the input required. Brazilian distillers can produce sugarcane ethanol for just 22 cents per liter, compared to 30 cents for corn-based ethanol, giving it a clear cost advantage.

Sugarcane’s environmental credentials are equally impressive. It reduces greenhouse gas emissions by up to 91% compared to gasoline, far surpassing corn ethanol’s 18% reduction. The U.S. EPA even designated Brazilian sugarcane ethanol as an advanced biofuel due to its 61% reduction in lifecycle emissions, a status that boosts its appeal in global markets. Plus, sugarcane mills use bagasse (the fibrous residue) to generate 100% of their energy needs, with surplus electricity often sold back to the grid. This circular system makes sugarcane ethanol a sustainability superstar.

Brazil’s flex-fuel vehicle market, where drivers can choose between ethanol and gasoline, further cements sugarcane’s dominance. With ethanol blends mandated at 25% in gasoline (and talks of increasing it to 30%), and hydrous ethanol (E100) widely used in flex-fuel cars, sugarcane ethanol powers a significant chunk of Brazil’s transportation sector. The RenovaBio program, a national biofuel policy, sweetens the deal by rewarding producers with carbon credits based on their ethanol’s environmental performance.

Corn vs. Sugarcane: A Complementary Dance

So, is corn ethanol here to dethrone sugarcane? Not quite—it’s more of a complementary partnership. Sugarcane ethanol is less competitive when sugar prices soar, as they did in 2024, reaching a 15-year high gap over ethanol prices. This has pushed many mills to allocate more sugarcane to sugar production, leaving room for corn ethanol to fill the gap. Flex plants, which can process both sugarcane and corn, are a game-changer, allowing mills to switch feedstocks based on market conditions. For instance, São Martinho’s new corn ethanol plant lets it prioritize sugar while still boosting biofuel output.

Corn ethanol also addresses regional challenges. In the Center-West, where sugarcane is less prevalent, corn ethanol provides a local solution, reducing transport costs and leveraging the region’s massive corn production. By 2030, corn ethanol could account for over 30% of Brazil’s ethanol supply, up from 20% today, according to industry projections. Yet, sugarcane’s efficiency and sustainability ensure it remains the preferred choice in traditional strongholds like São Paulo, which produces 58% of Brazil’s ethanol.

Challenges and Opportunities

The ethanol boom isn’t without hurdles. Corn ethanol’s rapid expansion relies on subsidized credit, and without it, some projects may struggle to stay viable. Meanwhile, sugarcane ethanol faces challenges from fluctuating global sugar prices and the growing popularity of electric vehicles, which could dampen demand for biofuels. However, Brazil’s ethanol industry is poised for growth, with opportunities in second-generation ethanol from sugarcane bagasse and even sustainable aviation fuel (SAF). Raízen SA and FS have already earned certifications for SAF production, signaling Brazil’s potential to lead in next-gen biofuels.

Looking Ahead

Brazil’s ethanol industry is at a crossroads, with corn ethanol carving out a significant niche while sugarcane holds its ground as the gold standard. This dynamic duo is driving Brazil’s position as the world’s second-largest ethanol producer, with a projected market value of US$33.77 billion by 2032, growing at a 6.5% CAGR. As policies like RenovaBio and global demand for sustainable fuels continue to shape the market, Brazil is set to remain a biofuel powerhouse.

So, whether you’re cheering for corn’s meteoric rise or sugarcane’s steadfast reign, one thing’s clear: Brazil’s ethanol industry is fueling a greener future with innovation and ambition. Stay tuned for more updates in next month’s Biofuel Bulletin—and let’s keep the momentum going!—OneBizTutor®

Brazil in the Spotlight: The M&A Market is Booming – J.P. Morgan Doubles Down on Growth

Dear Readers,

picture this: In a world swirling with economic turbulence and political uncertainties, Brazil shines as a beacon of opportunity. Yes, you heard that right – the Brazilian Mergers & Acquisitions (M&A) market has posted an impressive +20% growth in the first half of 2025, reaching a volume of $28 billion. That’s not just a number; it’s a signal! A signal that investors like J.P. Morgan can’t ignore. Let’s dive into this exciting development and explore why now is the perfect time to put Brazil on your radar. I promise, by the end of this article, you’ll be inspired to take action – whether it’s rethinking your strategy or sparking a lively discussion with your team.

A Strong Start to the Year: From 20% Growth to New Heights

First, let’s talk facts that make us all sit up and take notice: Compared to last year, Brazil’s M&A market has made a powerful leap. With $28 billion in deal volume in the first half of 2025, we haven’t yet hit historic peaks, but the trend is unmistakably upward. Remember, 2024 saw a total volume of $52 billion – and J.P. Morgan is boldly forecasting that we’ll surpass this mark in 2025. That’s more than optimism; it’s grounded in solid indicators that are expected to hold strong in the coming quarters.

What’s driving this boom? Well, despite significant economic and political challenges – from inflation pressures to regulatory hurdles – we’re seeing massive interest in Brazil. International players are sensing opportunities, and rightly so. On the domestic market, multipliers and indices point to conditions that favor buyers: lower valuations, attractive returns, and growing liquidity make deal-making easier. Here’s my clear take: In times of uncertainty, markets like these are goldmines. They reward the bold who act rather than wait.

J.P. Morgan Doubles Down: New Talent and Global Ambitions

And who’s leading the charge? J.P. Morgan, the investment bank that never sleeps. In response to this positive trend, the firm has expanded its presence in Brazil – including hiring new professionals specifically for the M&A space. That’s proactive action at its finest! Imagine these expert teams now forging deals with fresh momentum, impacting not just locally but globally.

Here’s the exciting part: The market for Brazilian companies with acquisition opportunities abroad is also on the rise. The U.S. market stands out as a top destination. Why? Because Brazilian firms are increasingly looking to expand in technology, energy, and consumer goods – and the U.S. offers the perfect playground. Think of innovative cross-border deals that create synergies and unlock growth potential. In a lighthearted nod: When Brazil and the U.S. hit the dance floor, they create a samba that makes stock markets vibrate!

Challenges as Opportunities: Solution-Oriented Progress

Of course, dear readers, it’d be naive to ignore the hurdles. Brazil faces political instability, currency fluctuations, and global pressures like rising interest rates. But here’s the beauty: These challenges are surmountable and offer room for innovative approaches. My advice? Think outside the box! Leverage tools like digital due-diligence platforms or AI-driven market analysis to minimize risks and maximize opportunities. For investors: Focus on sectors like renewable energy or tech startups, where Brazil is catching up fast.

Here’s a solution-oriented tip: If you’re active in M&A, start with a thorough market analysis. Reach out to experts like those at J.P. Morgan – or, why not, spark a networking conversation? The trend is your ally; use it to strengthen your portfolio.

Outlook: Brazil as a Game-Changer

In summary: Brazil is on track to become an M&A hotspot that will set new benchmarks in 2025. J.P. Morgan’s commitment is a clear vote of confidence, and I’m convinced we’ll see even more dynamic deals in the coming months. Let’s take this as a call to action – inspire your team, be proactive, and seize the moment!

Have your own experiences with the Brazilian market? Share them in the comments or via email – we would love to keep the conversation going. Stay tuned for more insights in our next newsletter!

Stay safe on your project trail! Subscribe with your email!

Ups & Downs

Summary of Brazil's Economic Performance in 2025 so far

Brazil’s economy in 2025 is like a samba dancer—vibrant, dynamic, and occasionally tripping over its own feet but still stealing the show! Let’s break down the key highlights with a proactive, solution-oriented lens, sprinkled with a bit of wit to keep things lively.

Vehicle Sales: Revving Up the Engine

In July 2025, Brazil’s new vehicle sales hit the gas, reaching nearly 230,000 units—a modest 1.2% increase from July 2024 and a robust 14% surge from June 2025. Passenger cars and SUVs led the charge, while commercial vehicles like buses and trucks kept pace with a 0.8% year-on-year rise and a 14.25% month-on-month jump. Pro tip: If you’re in Brazil, now’s a great time to cruise into a dealership—those shiny new rides are clearly in demand!

Digital Commerce: Clicking and Gifting

Online shopping is thriving, with digital commerce growing 7% in the first half of 2025 compared to 2024. Gift purchases via digital channels rose by 5%, proving Brazilians are not just browsing—they’re spreading joy! Solution: Retailers, keep those e-commerce platforms sleek and user-friendly to ride this wave of generosity.

Mergers & Acquisitions: Financial Sector Frenzy

The financial sector is buzzing like a beehive, with M&A deals soaring 97.4% in the first half of 2025, per KPMG Brazil. Brazilian companies dominated 58% of these deals, while foreign investors snapped up 42% of stakes. Insight: This signals Brazil’s financial market is a hot ticket—investors, both local and global, see serious potential here. Time to join the party?

Real Estate in São Paulo: Building Dreams

São Paulo’s real estate market is on fire (in a good way)! June 2025 saw a 6% increase in activity compared to June 2024, with new apartments and first-time occupancy homes jumping 9.6%. Over the past year, new property supply in the city skyrocketed by 44%. Motivational nudge: First-time buyers, seize this moment—your dream home is waiting, and the market’s got plenty to offer!

Pharmaceutical Industry: Healthy Growth

Brazil’s pharmaceutical sector is in top shape, with sales hitting USD 28 billion in the first half of 2025, up 11.5% from 2024. National labs and manufacturers, holding 58% of the market, grew 12% year-on-year. With solid growth projected for the next five years, this sector is a powerhouse. Humor alert: Looks like Brazil’s not just prescribing growth—it’s filling the prescription too!

Private Consumption: Defying the Holiday Slump

Private consumption in July 2025 grew 4% compared to July 2024 and 2.4% from June 2025, with a year-to-date increase of 2.7%. Despite the usual school holiday slowdown, Brazilians kept spending. Opinion: This resilience is a testament to consumer confidence—let’s keep the momentum going with smart, inflation-adjusted spending strategies!

Chinese Cars: Zooming into Brazil

Chinese car brands are stealing the spotlight, with demand surging 24% from January to July 2025 compared to 2024. Chery led with a 44.2% increase in inquiries, followed by BYD at 34%. Innovative idea: Brazilian dealers, stock up on these brands—your customers are clearly curious about these stylish imports!

Retail Market: A Mixed Bag

Retail sales in Brazil grew 4.3% overall in 2025, but July saw a slight 0.9% dip compared to July 2024—the second decline this year. Meanwhile, customer visits to physical stores tanked, dropping 13% in shopping centers and 8% in street stores, with the southern states hit hardest (down 9%). Yet, sales eked out a 0.3% gain. Solution: Retailers, pivot to hybrid models—bolster online presence while sprucing up in-store experiences to lure those window-shoppers back!

Consumer Confidence: A Tiny Dip, But Still Smiling

Consumer confidence slipped 0.3% in August 2025 from July and 0.6% from August 2024, per CNC. Still, the index remains positive. Motivational spin: A slight frown doesn’t stop the party—Brazil’s consumers are still optimistic, so businesses should keep engaging with bold marketing and value-driven offers.

Energy Storage Batteries: Powering Down Prices

Prices for energy storage batteries in Brazil are set to drop 15% in 2025, following a 40% plunge in 2024. No price hikes have ever been recorded—talk about a shocking deal! Forward-thinking idea: This is a golden opportunity for renewable energy adoption—businesses and households, invest in these batteries to power a sustainable future!

Final Takeaway

Brazil’s economy in 2025 is a vibrant mix of growth and challenges, with sectors like automotive, real estate, and pharmaceuticals leading the charge, while retail faces headwinds. The key? Stay adaptable, embrace digital trends, and capitalize on consumer optimism. Let’s keep the samba going—Brazil’s economic rhythm is still strong, and with a bit of innovation, it’s poised to shine even brighter!

—your OneBizTutor® Market Snapshot

One stop subscription. If you don´t like it, unsubscribe with one smash!

News from iMB.Solutions

OneBizTutor® Launch, Aug. 27, 2025

Subject: Stop Guessing. Start Building. Introducing OneBizTutor®.

Dear Business Leader,

in a world that rewards speed, the traditional consulting model has become a liability. It's a world of slow analysis, opaque pricing, and static reports that kill the very momentum they're meant to create. The time for a new approach isn't coming—it's here.

Last week, we at iMB.Solutions are thrilled to officially launch OneBizTutor® - The Hybrid Business Intelligence Engine. We've created a service designed for the innovators, the builders, and the leaders who need to move from idea to impact with velocity and certainty.

What is OneBizTutor®? A New Engine for Strategy.

OneBizTutor® is a sophisticated, multi-layered system that combines the best of machine intelligence with the irreplaceable value of human expertise. It’s designed to give you a clear, data-driven, and actionable path forward.

At its core is our Hybrid Engine, a digital team that works in perfect sync:

The DataSuperCharger: This is the first step. It takes all the chaotic, raw data surrounding your project and organizes it into a clean, structured foundation for analysis.

The M-SLM (The Specialist Analyst): This is where our precision comes from. Unlike a generalist LLM, our Micro-Small Language Model (M-SLM) is a purpose-built specialist. It performs deep, highly accurate analysis on your specific business data with incredible speed and security. It finds the critical signals that a generalist AI would miss.

The LLM (The Creative Contextualizer): The clean, reliable facts from the M-SLM are then passed to a Large Language Model. This is the creative engine that brainstorms a wide array of relevant, data-backed strategic scenarios and possibilities.

But technology alone is not the answer.

The Irreplaceable Human Element: Your Curator & Validator

The "hybrid" in our engine is our most critical component. An iMB.Solutions human expert acts as the Curator and Validator throughout the entire process. They provide the strategic nuance, real-world wisdom, and ethical oversight that no algorithm can replicate. They transform the AI's powerful output into a sound, practical, and accountable business strategy.

Unparalleled Security: The Three-Layer Trust Architecture

We understand that your strategic data is your most valuable asset. That's why we built OneBizTutor® on a foundation of cryptographic certainty. Our Three-Layer Trust Architecture protects your vision with:

Strict Compliance with global data protection laws like GDPR and LGPD.

A Zero AI-Training Policy, ensuring your proprietary data is never used to train any AI model.

A Secure Decentralized Infrastructure (Web3) that gives you true data sovereignty.

How It Works: Your Path to Clarity and Action

We offer three transparent packages designed for every stage of your journey:

Tier 1: The Spark: For entrepreneurs and innovators needing to rigorously test a new idea. We deliver a comprehensive validation report and a clear Go/No-Go/Pivot recommendation.

Tier 2: The Blueprint & Ignition: For startups and businesses ready for market entry. This package provides a complete, execution-ready "Launch Kit"—from your brand identity to your go-to-market strategy.

Tier 3: Market Intelligence Engine: A subscription service for executives and strategy teams who need a continuous, real-time view of their market to stay ahead of the competition.

The era of slow, expensive, and insecure consulting is over. The future is hybrid, transparent, and built on a foundation of trust.

We invite you to explore the new standard in strategic consulting and see how we can help you turn your vision into victory.

Sincerely,

The iMB.Solutions Team, São Paulo, Brazil

Get Out

Dear creative minds and art enthusiasts,

what an exhilarating privilege it is to spotlight a masterpiece that transforms an urban landscape into a canvas of inspiration! Today, we turn our gaze to the vibrant streets of Jardins, São Paulo, Brazil, where the renowned Brazilian artist Eduardo Kobra has left an indelible mark with his breathtaking graffiti. This stunning work, captured in the photo, is a testament to the power of art to ignite thought and color our world with innovation!

The artwork features a striking figure seated in a contemplative pose, encased within a luminous lightbulb—a brilliant metaphor for the birth of ideas. Kobra’s signature style shines through with a kaleidoscope of colors—vibrant reds, blues, yellows, and greens—blending seamlessly to create a human form that radiates energy and intellect. Positioned against the backdrop of a sleek, modern building, this piece elevates the everyday urban environment into a gallery of profound expression.

Located at the intersection of Paulista and Brigadeiro, this mural is more than just a visual delight—it’s a call to action! Let’s embrace the creativity it embodies and challenge ourselves to think outside the box in our own lives. Kobra’s work reminds us that every corner of our cities can become a space for inspiration, urging us to reflect, innovate, and contribute to the cultural tapestry around us.

So, let’s take this as a motivating cue! Visit this masterpiece if you’re in São Paulo, or seek out local art in your own community. Share your thoughts and photos—let’s spark a dialogue about how art shapes our world. Together, we can illuminate new ideas and celebrate the brilliance of human creativity!

Warmest regards,

Frank P. Neuhaus

Contact

You want to subscribe to the newsletter? OK, take your smartphone and scan the QR code!

Discover What Matters Most to You—Backed by 140+ Project Missions!

Curious about the impact of our insights at iMB.Solutions? We put our articles, blogs, and case studies to the test—running three independent AI-driven queries with Perplexity, Google Gemini, and Mistral. The result? A powerful keyword cloud reflecting the topics that truly resonate.

Do you see yourself in these trends? Let’s connect and explore how our expertise—shaped by 140+ project missions over two decades—can drive your success.