GreyRhino newsletter Edition November 2025

Discover the GreyRhino Newsletter by iMB.Solutions!

Stay ahead of the curve with the GreyRhino newsletter, your go-to source for insightful analysis and expert commentary straight out of the project missions. Curated by iMB.Solutions, this newsletter dives deep into the "grey rhino" events—highly probable, high-impact threats that we often overlook.

Why Subscribe?

Expert Insights: Gain access to Frank P. Neuhaus's unique perspectives and in-depth analysis on global risks and opportunities.

Timely Updates: Stay informed with the latest developments and trends that could impact your business and personal life.

Actionable Advice: Learn practical strategies to navigate and mitigate risks, ensuring you're always prepared for what's next.

Join a community of forward-thinking professionals who are committed to staying informed and proactive. Don't miss out on the valuable knowledge and insights shared in the GreyRhino newsletter.

📥 Subscribe now on iMB.Solutions webpage and turn potential threats into opportunities!

Sign up with your email address to receive news and update!

Prime Story

Argentina 2027: Navigating the Forked Roads After Milei's Midterm Mandate

Buenos Aires Dispatch - November 12, 2025

Dear subscribers & blog followers,

in the sweltering heat of a Buenos Aires spring, Argentina's midterm elections on October 26 delivered a seismic verdict: President Javier Milei's La Libertad Avanza (LLA) surged to a landslide victory, capturing over 40% of the national vote and expanding its congressional footprint.

This wasn't just a win; it was a mandate.

With enough seats to shield his vetoes from override and a fragmented opposition in disarray, Milei now holds the reins to accelerate his libertarian revolution—deregulation, privatization, and fiscal austerity on steroids. Markets erupted in euphoria: the Merval index rocketed 22%, the peso strengthened 10%, and bonds rallied as investors bet on deeper reforms.

Yet, as the confetti settles, the real race begins—not for seats, but for the soul of the nation. The 2027 presidential contest looms large, with Milei's re-election bid (or succession plan) hanging in the balance. Inflation, while easing to 31.8% year-over-year in September from 33.6% in August, remains a stubborn beast, averaging a still-painful 1.7-2.1% monthly. The economy shows glimmers of recovery—Q2 GDP growth hit 6.3%, investment surged 32%—but real wages are eroded, poverty lingers above 40%, and external wildcards like U.S. trade policies under a potential Trump 2.0 could upend everything. Milei's approval, dipping to lows pre-election, has rebounded on the back of this triumph, but his bombastic style risks alienating the moderate middle class craving stability.

Against this backdrop, we've outlined six plausible scenarios for Argentina's trajectory through 2027. Each draws on the midterm momentum while grappling with economic fault lines and political fault lines. We'll dissect their mechanics, drivers, implications, and rough likelihoods—grounded in today's data, where optimism tempers caution. Scenario 4, as noted, feels like a long shot amid Milei's consolidated base. But chaos, as Argentina knows well, is the great equalizer.

Scenario 1: Collapse and Backlash – The Peronist Phoenix Rises from the Ashes

Picture this: A rogue IMF tranche delay or a commodity price plunge ignites a full-blown peso meltdown. Reserves evaporate, hyperinflation flares back to triple digits, and street protests—fueled by pensioners and piqueteros—engulf the Plaza de Mayo. Milei's "shock therapy" narrative crumbles under the weight of empty shelves and blackouts, dragging his approval below 20%, a death knell in a nation weary of pain without gain.

The opposition, sensing blood, reunifies under a Peronist banner. Axel Kicillof, the cerebral Buenos Aires governor with populist flair, or Máximo Kirchner, the dynastic heir wielding La Cámpora’s machine, emerges as the standard-bearer. Their platform? A swift reversal: Restore AUH child allowances, triple energy subsidies, and nationalize key exports to "feed the people." No more chainsaw; it's hammer time. In the 2027 first round, Peronism storms to 45-50% outright, bypassing a runoff.

Post-Milei Argentina veers sharply left: State control expands via price caps and currency controls, echoing the Kirchnerist heyday. The IMF, cornered by default threats, caves to softer terms—perhaps injecting $15 billion in emergency funds tied to minimal austerity. Private capital flees to Uruguay and Chile, yields on Argentine bonds spike to 25%, and Beijing circles vultures, offering Belt and Road loans for lithium mines and soy ports. Geopolitically, it's a BRICS pivot: Closer ties to Lula's Brazil and Petro's Colombia fizzle as Argentina drifts toward Moscow's orbit for cheap gas.

Likelihood: Low (15%) – Midterms show voter fatigue with Peronism's 25% share; the economy's Q2 rebound undercuts crash narratives. But a black swan—like a U.S. recession hammering soy exports—could flip this. Implications? A vicious cycle of populism and debt, stalling regional integration and inviting sanctions from a hawkish Washington.

Scenario 2: Stagnation – The Slow Bleed and the Centrist Mirage

Here, the economy limps along a tightrope: Inflation plateaus at 40-50%, gnawing at real wages (down 15% since 2023) while mining booms in the Andes and agribusiness props up exports. No cataclysm, but no catharsis—GDP growth sputters at 2-3%, unemployment hovers at 9%, and black-market dollars trade at 2:1 premiums. Milei's pyrotechnics—Twitter rants and culture-war crusades—wear thin, alienating PRO moderates like Horacio Rodríguez Larreta, who decamp to form a "sane right" bloc.

Corruption whispers, perhaps a YPF privatization scandal or nepotism in the AFIP tax agency, erode his halo further. Congress remains a quagmire: LLA's midterm gains buy time, but veto-proof majorities elude, stalling labor reforms. The right fractures—Milei loyalists versus a resurgent PRO courting business chambers—opening the door for Peronism's pivot. Enter the "Union por la Normalidad": A center-left coalition led by Sergio Massa’s ghost (or Cristina Fernández de Kirchner's endorsement), promising technocratic tweaks like gradual devaluation and "smart" subsidies. Kicillof lurks in the shadows, bankrolling from Buenos Aires coffers.

They clinch 2027 with 38% in a fragmented first round, edging Milei in a runoff amid 65% turnout. Governance? Pragmatic drift: Inflation caps at 30% via IMF-lite deals, but cronyism creeps back, growth idles at 1%. Foreign policy mellows—WTO compliance for EU trade perks, but no bold lithium alliances.

Likelihood: Medium (25%) – Aligns with persistent inflation forecasts (IMF at 41.3% for 2025) and historical right-wing infighting. Post-midterm fragmentation risks persist, but LLA's 40% haul suggests cohesion for now. Downside: Voter exhaustion favors status quo, but stagnation breeds radicals.

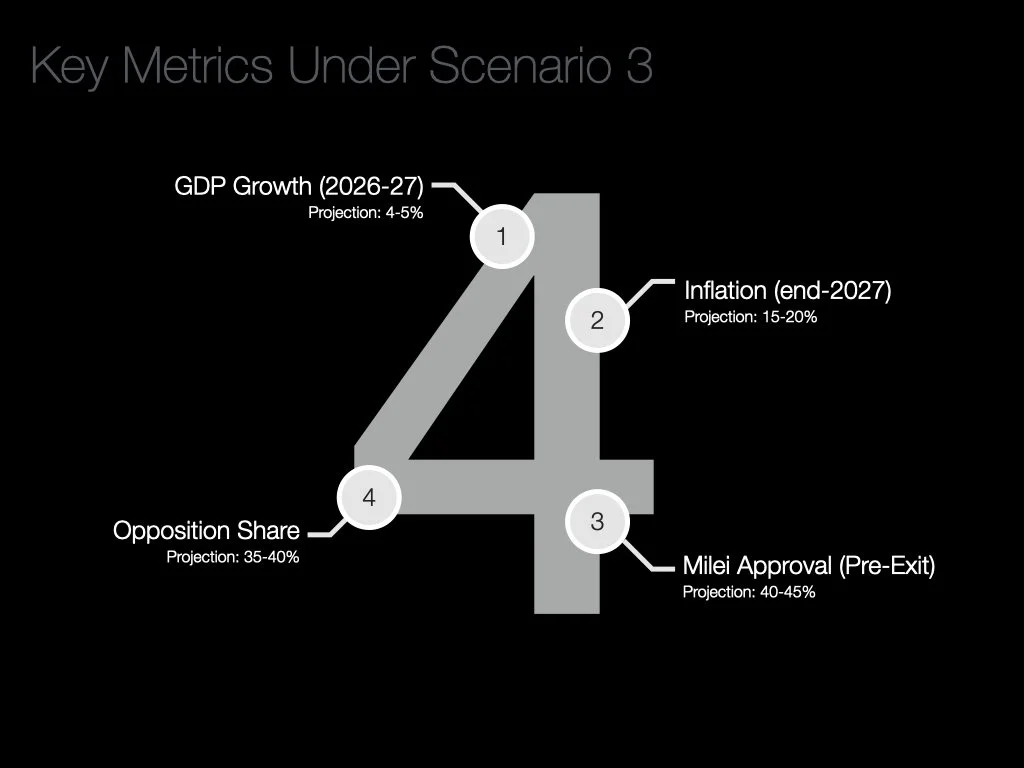

Scenario 3: Conservative Continuity – From Anarcho-Capitalist to Institutional Anchor

Irony abounds: As reforms bear fruit—Q2's 6.3% growth accelerates to 5% annually, reserves hit $40 billion—Milei's outsider schtick loses its edge. Voters, flush with middle-class gains (real incomes up 5%), tire of his antics: A leaked audio of him mocking "woke" judges or a family feud in the Casa Rosada tarnishes the brand. Approval stabilizes at 45%, but "Milei fatigue" sets in; he's the visionary who fixed the roof but won't stop yelling about the storm.

Enter the succession: A polished torchbearer like Patricia Bullrich, the steely security minister with PRO roots, or a Milei acolyte like Federico Sturzenegger, anointed by Wall Street and the UIA industrialists. Backed by a "Continuidad y Orden" coalition, they campaign on "Milei 2.0—Without the Mayhem": Lock in privatizations (YPF stake sales fetch $10B), but add social buffers like targeted vouchers. The right holds: 52% in the runoff, blending libertarian zeal with PRO discipline.

Argentina evolves into a "Chile-lite": Pro-market but with congressional buy-in, inflation dips to 20%, FDI floods Vaca Muerta shale. Milei? A kingmaker elder statesman, perhaps UN ambassador, his legacy intact but ego bruised. Internationally, it's Davos darling status—Mercosur reforms, CPTPP bids—while Peronism withers to regional fiefdoms.

Likelihood: Medium-High (20%) – Midterm mandate signals continuity appetite, and economic upticks (OECD's 5.2% projection) erode anti-system appeal. Risks: If scandals multiply, Bullrich's hawkishness could polarize.

Scenario 4: The Populist Pivot – Milei's Last Stand in the Rubble

Defiance defines this dystopia: Even as inflation spirals to 60%, the IMF freezes talks over fiscal slippage, and capital flight drains $20B in reserves, Milei clings like a cactus. He amplifies the megaphone—"The casta in Congress and greedy unions sabotaged salvation!"—rallying his base with TikTok tirades and Davos walkouts. Blame sticks: Peronists feud over Cristina's shadow, PRO implodes on abortion divides, and moderates like Elisa Carrió float third-way mirages.

Turnout craters to 60% in a toxic atmosphere—voter rolls "glitches" and opposition boycotts fuel cries of fraud. Milei scrapes 37% in round one, then 51% in a runoff against a Peronist placeholder, amid Supreme Court probes into "irregular" campaign funds from crypto donors. Victory? Pyrrhic. Policy grinds: Dollarization stalls on congressional vetoes, blackouts persist, but anti-elite fervor sustains veto power.

Long-term? A hollow throne: Growth flatlines at 0%, emigration spikes (500K youth flee), and Milei governs as a lame-duck autocrat, echoing Fujimori's Peru. Allies like Trump offer rhetorical props—a $5B "friendship loan"—but isolation grows; even Brazil tariffs Argentine beef.

Likelihood: Very Low (5%) – Midterms' 40%+ haul and market rally contradict collapse preconditions; fragmented foes favor clean wins. Pure chaos required—think coup rumors or pandemic redux.

Scenario 5: Resilient and Patient Voters – The Grudging Re-Endorsement

Stagnation redux, but with a twist of tolerance: Inflation locks at 45-50%, wages lag, yet no abyss yawns thanks to litio exports (+25% yoy) and wheat windfalls. Milei reframes masterfully: "We stanched the hemorrhage—from 300% inflation to half. The scalpel works; patience heals." Markets, buoyed by midterm vibes, hold steady—peso at 1,200/USD official, reserves at $30B. Dollarization whispers fade as voters prioritize the devil they know.

The middle class, nursing grudging respect for fiscal discipline (deficit at 1% GDP), sticks with him; anti-system diehards (20% of electorate) form the core, while PRO challengers flounder without star power. Exhaustion dooms the opposition—Peronists at 30%, splintered right at 15%. Milei ekes 42% in round one, 52% in the runoff: Legitimate, if uninspired, on 70% turnout.

Governance mellows: Incremental wins like RIGI investment perks yield 3% growth, but unions extract wage hikes. Legacy? A stabilized but unequal Argentina—poverty dips to 35%, but inequality (Gini 0.45) festers. Foreign ties: Pragmatic—IMF renewals, quiet China deals for dams.

Likelihood: High (20%) – Mirrors current inertia (inflation down but sticky) and midterm "low expectations" vote. Strong if external shocks absent.

Scenario 6: The Market Messiah – Vindication and the Libertarian Dawn

The dream sequence: Structural tweaks ignite—YPF auctions draw Exxon bids, Vaca Muerta pipes 100 BCM gas yearly. Inflation plunges to 8% by mid-2026, reserves swell to $60B, GDP roars at 7%. Milei, the prophet in the wilderness, crows vindication: "Told you so!" Poor Peronist defectors—factory workers with 20% real wage bumps—flock to his banner, swelling the tent to include UCR liberals and ag barons.

The coalition? "Libertad Sostenible": 55-60% blowout in 2027, first-round majority. Milei consolidates a bloc transcending him—think young techies, salteño miners, porteño entrepreneurs—outlasting Peronism's rust. Policy paradise: Full dollarization by 2028, flat taxes at 15%, universal basic income pilots. Argentina joins OECD talks, lures Tesla gigafactories, and brokers Mercosur 2.0 with Uruguay. Milei? Global icon, perhaps OAS head, his chainsaw retired to a museum.

Likelihood: Medium-High (15%) – Midterm markets and growth data (6.3% Q2) tilt bullish; IMF's 41% inflation cap could accelerate if reforms stick. But execution risks loom—labor unrest or commodity busts.

Scenario comparison by TangoTech, Buenos Aires, October/November 2025

Closing the Loop: Odds, Wildcards, and the Horizon

Tallying it up: Scenario 5 edges as frontrunner at 20%—patient voters rewarding midterm grit amid sticky inflation—followed by 3 and 6 at 20% each, buoyed by recovery signals. Collapse (1) and pivot (4) lurk at the tails, while stagnation (2) broods at 25%.

Wildcards?

A Trump tariff wall craters exports (boosting 1 or 2); dollarization fiat via decree (juicing 4 or 6); or "utter chaos"—say, a dengue epidemic or Macri comeback—upends all. External shocks like Fed hikes could spike dollar premiums, while lithium geopolitics offers upside.

Argentina stands at a precipice, not a pit. Milei's midterm masterstroke buys time, but 2026/27 tests if libertarian delivers loaves, not just sermons. Stay tuned— we'll track the pulse.

Hasta la victoria, or whatever comes next. TangoTech,

TangoTech - Cordoba (Argentina) - Montevideo (Uruguay) - for iMB.Solutions Ltda. - 2025

Meet “TangoTech”, team member of the dynamic duo behind the innovative crypto currency project for Argentina: CryptoARGVault.

"TangoTech" is a visionary young entrepreneur from Cordoba, Argentina. Her career in finance and economics laid the foundation for her deep understanding of the unique challenges faced by the Argentine economy. TangoTech believes in the potential of blockchain to reshape financial landscapes and empower individuals. Her interest in crypto stems from a desire to create inclusive financial solutions that can transcend geographical boundaries and traditional financial barriers. TangoTech is passionate about community engagement and user experience design. She thrives on building bridges between technology and real-world applications. In her free time, TangoTech is an enthusiastic sustainable whine growing professional and loves exploring Argentina's rich cultural heritage.

Sign up with your email address and smash the subscribe button!

impressive story from the industry newsroom with high transformational potential

professional service, Brazil

Brazil's Management Revolution: Interim Expertise Fuels a 15% Growth Surge in 2025

São Paulo, November 6, 2025 – Imagine this: Your company hits a growth spurt, but your C-suite is stretched thinner than a samba dancer's patience during carnival traffic. Enter interim management – the agile, on-demand saviors of Brazilian business. In a year that's already defied economic headwinds with resilient flair, temporary management, interim leadership, and management-on-demand services are exploding onto the scene, clocking a staggering 15% growth rate over 2024. And the best part? The horizon for 2026 and beyond looks brighter than a Rio sunrise. If you're not tapping into this trend yet, consider this your wake-up call – because in Brazil's dynamic market, flexibility isn't just smart; it's survival.

São Paulo, Brazil, south district

As we navigate the third quarter of 2025, the numbers don't lie. Brazil's services sector, which powers nearly 60% of the GDP and employs seven in ten workers, is undergoing a seismic shift toward nimble, expertise-driven solutions. Interim management – think seasoned executives parachuting in for 6-18 months to steer turnarounds, launches, or digital overhauls – is no longer a luxury for multinationals. It's becoming the go-to for startups, mid-sized firms, and even legacy players adapting to AI disruptions and sustainability mandates. This isn't hype; it's a response to a booming ecosystem where São Paulo's startup investments have quadrupled in just two years, demanding rapid, high-caliber talent without the long-term payroll drag.

Why now? Let's cut through the noise. Brazil's economy is projected to cool from a robust 3.4% expansion in 2024 to 2.1% this year and 1.6% in 2026, per OECD forecasts, but that's no recession – it's recalibration. With inflation tamed and unemployment at historic lows, businesses are prioritizing agility over headcount. Enter on-demand services: Platforms and consultancies like those spotlighted in recent industry reports are surging in demand, with a "compelling narrative" of interim pros filling critical gaps in a post-pandemic world that's all about speed. Humor me for a second – if traditional hiring is like committing to a blind date for life, interim management is the fun, no-strings fling that might just turn into your soulmate strategy. And in Brazil, where bureaucracy can rival a telenovela plot twist, this model's efficiency is pure gold.

But here's where I get opinionated: This 15% leap isn't just a statistic; it's a clarion call for innovation. Brazilian leaders, let's lean in – interim talent isn't a Band-Aid; it's rocket fuel. Picture injecting a supply-chain wizard into your agribusiness during harvest chaos or a fintech guru to navigate Pix's next evolution. The result? Faster pivots, lower risks, and ROI that traditional hires can only dream of. Globally, on-demand staffing is barreling toward a $112 billion market by 2033, and Brazil's slice is fattening quickest, buoyed by our young, skilled workforce and a middle class that's hungrier than ever for premium services. For 2026, expect the momentum to hold: Services PMI projections hover at 51 points, signaling steady expansion, while fiscal reforms could spark an investment rally that amplifies demand even further.

So, what's your move? If you're a CEO eyeing that next merger or a startup founder bootstrapping your unicorn dream, don't wait for the market to mandate change – orchestrate it. Partner with vetted interim networks today; audit your talent gaps tomorrow; and by Q1 2026, you'll be the one others are benchmarking. At [Your Newsletter Name], we're all about proactive plays that turn trends into triumphs. Drop us a line at info@imb.solutions with your interim success stories – who knows, your tale might inspire the next wave.

Here's to Brazil's bold new era of management mastery. Let's make 2025 the year we didn't just adapt – we dominated.

Stay agile, stay inspired,

Empowering Brazil's Business Innovators

The LatAm Story

Lithium: The "White Gold" Rollercoaster – From Boom to Bust and Back Again?

The lithium market is serving up a masterclass in economic volatility that's equal parts thrilling and cautionary! Often dubbed "white gold" for its pivotal role in electrifying our world—from electric vehicles (EVs) to renewable energy storage—this abundant mineral has plummeted a staggering 86.5% since its late-2022 peak. Let's dive into the drama, unpack the drivers, and chart a proactive path forward. After all, in the words of savvy investors: What goes down must come up—smarter and stronger!

Salinas in Salta Province, Argentina

The Epic Price Plunge: From $68/kg to $9.26/kg

Picture this: In December 2022, lithium carbonate averaged a whopping US$68 per kilogram. Fast-forward to last month, and it's languishing at just US$9.26—even after China hit the brakes on major mines, sparking global supply jitters. This isn't a minor dip; it's a full-blown correction fueled by:

Global Oversupply: Mining giants raced to meet EV demand, flooding the market.

EV Market Slowdown: Growth persists worldwide, but not at the breakneck pace once predicted.

Humorously, lithium's journey mirrors a blockbuster thriller: Pandemic-era shortages spiked prices to unsustainable highs (think US$70/kg in 2021–2022, thanks to China's EV incentives and limited supply). Then, boom—supply catches up, and prices crash 63% in just four months (December 2022 to April 2023). They've hovered at pre-pandemic levels (US$7–9/kg) for over a year now. Oversupply? Check. Market maturation? Double check.

Pro Tip: History shows extremes breed opportunities. High 2022 prices burdened consumers (lithium is ~4% of an EV's cost), but today's lows scream "strategic positioning" for resilient players.

average price per month

Global Supply Surge: The Heroes (and Villains) of Production

Mining companies didn't sit idle. From 2021–2024:

Australia: Boosted output by nearly 100%.

Chile: Ramped up 75% (per Argus Media data).

Add in expansions from Brazil, Zimbabwe, and China, and voila—an abrupt shift from shortage to surplus. China's wildcard? Tapping lepidolite reserves in 2023 for integrated, low-cost production. This verticalization dragged global benchmarks down, as Chinese prices set the tone.

Recent twist: Beijing's regulatory overhaul under Xi Jinping—reviewing mining licenses amid excess capacity and deflation—suspended operations in August. Expert Flávio Vegas of Global X ETFs quips: "China overstepped, creating oversupply. Now, they're blocking to buoy prices." Is this the spark for recovery? Stay tuned!

Brazil's Lithium Landscape: Resilience Amid the Storm

In Brazil, the low-price blues have hit hard, delaying projects and testing mettle. But here's where innovation shines—let's spotlight the trailblazers turning challenges into triumphs:

Companhia Brasileira de Lítio (CBL): The nation's oldest player postponed expanding mining from 50,000 to 10,000 tons/year and refining capacity. At break-even, execs eye 2027 for price recovery. Solution-Oriented Insight: With EV growth intact, CBL's pause is prudent—preserving capital for a stronger rebound.

Sigma Lithium (Minas Gerais): Stockpiled Q2 production amid rock-bottom prices, eyeing year-end sales. They need US$100/kg for a quarter to greenlight expansions but are slashing costs to fortify competitiveness. Bold Opinion: This stockpiling strategy? Genius hedging—think of it as a lithium "wine cellar" aging for premium value!

AMG Brasil (Dutch AMG subsidiary): Defied odds by completing a 44% capacity hike this year. President Fabiano Costa affirms verticalization plans (refining in Brazil) push to 2029 (from 2022's 2025 target). Diversification into tin and tantalum? Their survival superpower. Costa targets US$23–27/kg for chain stability. Innovative Angle: Multimaterial mining isn't just backup—it's a blueprint for sustainable portfolios in volatile commodities.

Executive Summary Overview (2025)

The Big Picture: Electrification's Unstoppable March

It is predicted electrification will flip the script, but not to 2022 highs. Oversupply was a necessary correction—painful, yet pivotal for affordable EVs. This isn't EV failure; it's market evolution.

Our Clear Opinion: Lithium's dip is a golden (or white gold?) opportunity for diversification, cost innovation, and policy tweaks. Brazil, with abundant reserves, could lead by incentivizing integrated refining—think tax breaks for green tech hubs!

Actionable Takeaways: Power Up Your Strategy

Diversify Like AMG: Don't put all eggs in one mineral basket—explore synergies with electronics (tantalum) or renewables.

Stockpile Smartly: Emulate Sigma; low prices = buying (or holding) signals.

Eye 2027 Horizons: Plan investments around projected recovery—pair with EV adoption forecasts.

Advocate for Balance: Push for global policies curbing extremes (e.g., anti-dumping measures on oversupply).

What’s your take on lithium's next chapter? Will China’s blockade ignite a rally, or is patient positioning the real win? Drop your thoughts below—let’s dialogue and innovate together! Subscribe for more market motivators, and remember: In commodities, the bold rebound richest.—Frank P. Neuhaus for iMB.Solutions Ltda.

Sign up with your email address to receive news and updates!

From the Newsroom of Industry

Brazil's Agribusiness: Powering a Greener Future Through Bioenergy Innovation

Ignite Your Vision for Sustainable Growth: Brazil's Bioenergy Revolution is Here!

Imagine a nation where farms don't just feed the world—they fuel it. Brazil's agribusiness now commands nearly one-third of the country's entire energy matrix, a feat that positions the nation as a beacon of renewable energy excellence. Dive into this newsletter to uncover groundbreaking projects, bold projections, and massive investments that could catapult Brazil to global bioeconomy dominance. Ready to fuel your inspiration? Let's explore how innovation in bioenergy is transforming challenges into triumphs!

The Dominant Force of Agribusiness in Brazil's Energy Landscape

Brazil's energy story is one of resilience and foresight. In 2023, resources from agricultural activities powered 29.1% of the nation's total energy consumption, according to the latest report from the Getulio Vargas Foundation (FGV) Bioeconomy Observatory. This insight, drawn from the National Energy Balance (BEN) and released in May, highlights a staggering truth: when focusing solely on renewables—those regenerative powerhouses from nature—agribusiness surges to 60% of the mix.

Break it down further: The remaining renewable slice includes hydroelectric at 24.02%, wind at 5.24%, solar at 3.46%, natural vegetation wood at 6.98%, and biogas from non-agricultural waste like household refuse at a modest 0.22%. What drives this leadership? A wave of diversified initiatives that turn everyday farm outputs into energy gold.

Federal State of São Paulo (SP), Brazil

Picture this in action:

In Fortaleza, Ceará, Embrapa (Brazilian Agricultural Research Corporation) and the Federal University of Ceará (UFC) have engineered a cutting-edge system converting fruits and vegetables into biogas. Waste becomes wealth!

Down in Santiago, Rio Grande do Sul, the nation's pioneering wheat ethanol plant is rising, set to process 100 tons of cereal daily and yield 12 million liters of hydrated ethanol annually.

Looking skyward, a forward-thinking Brazilian firm—backed by the Brazilian Innovation Agency (Finep), the State University of Maringá, and German ministry funding—will launch a pilot plant in 2026. It aims to produce 100,000 liters of sustainable aviation fuel (SAF) from organic waste yearly, scaling to 40–80 million liters in the years ahead.

This trajectory traces back to the 1970s, when bioenergy from agriculture hovered at 6.5 million tons of oil equivalent (TOE). Fast-forward to 2023: over 91 million TOE. As study co-author Luciano Rodrigues emphasizes, this evolution underpins Brazil's status as home to one of the planet's most renewable matrices. "Strip away this bioenergy," he warns, "and our renewable share plummets to 20%—right at the global average."

Early dominance came from firewood and charcoal (40% in the 1970s), but programs like Proálcool supercharged sugarcane. A mid-period dip (1988–2003) saw ethanol stumble while liquor from pulp waste exploded from 1.2 million to 357 million TOE. Post-2003 revival? Flex-fuel vehicles and bagasse-powered bioelectricity. Today, sugarcane biomass rivals 48% of oil-derived energy supplies, with lye, firewood, and charcoal also on the upswing.

Brazil's edge? Abundant land, ideal climate, rich soils, and tropical-tuned tech.

contribution of Brazilian agro business

Future Projections: Three Pillars to Bioeconomy Supremacy

Why stop at today's wins? A forward-looking study by Imma—commissioned by Treesales Consulting and unveiled at Fenasucro & Agrocana in Sertãozinho, São Paulo, this August—maps a thrilling path on three axes.

Biotechnology Breakthroughs: Expect leaps in corn ethanol, second-generation sugarcane ethanol (adding 40 billion liters without land expansion), and SAF. Brazil could claim 25% of the global SAF market by 2030.

Digitization Drive: Smart operations slashing costs by 30% and boosting productivity 20% by the same deadline.

Carbon-Negative Ambition: Sequestering 50 million tons of carbon monoxide yearly, turning agriculture into a climate hero.

Treesales CEO Luciano Fernandes is bullish:

This trio gives Brazil a 65% shot at global bioeconomy leadership by 2030.

Proactively, let's seize these axes—innovate beyond conventions and lead the charge!

Evolution

Investments Fueling the Fire: Real Projects, Real Impact

Action speaks loudest. Geo Biogas & Carbon is pouring R$20 million into a pilot SAF plant using sugar, ethanol waste, and organics. Expect fuel with 50% fewer emissions, aligning perfectly with the Fuel of the Future Bill's 2027 aviation mandates.

Meanwhile, CB Bioenergia invests R$100 million in Santiago's wheat ethanol facility, targeting 50 million liters annually by 2027.

These aren't pipe dreams—they're engineered realities. In our view, such bold capital deployment isn't just smart; it's essential for outpacing global competitors. Think outside the silo: Pair these with policy tweaks and international partnerships, and Brazil doesn't just participate in the green transition—it orchestrates it.—M.M for iMB.Solutions Ltda.

Type your email, smash the subscribe button and get the next edition in your email inbox!

Short Cuts from Industries

Volkswagen's Bold Hybrid Push: Electrifying Brazil's Roads from 2026

A Volkswagen rolling off the line in São Bernardo do Campo, sipping ethanol or gasoline while its electric sidekick quietly trims fuel bills and emissions. That's not a distant dream—it's Volkswagen's committed roadmap starting in 2026. Every new model developed and produced across Latin America will boast a hybrid variant, spanning mild, full, or plug-in options. This isn't just an upgrade; it's a strategic leap to dominate sustainable mobility in a region hungry for practical innovation. Let's dive into the details and why this could supercharge Brazil's auto sector.

A New Hybrid Heartbeat in São Paulo

At the core of this transformation lies a cutting-edge platform under development at Volkswagen's São Bernardo do Campo plant in São Paulo. Engineered specifically for full hybrids and plug-in hybrids, it builds on the proven MQB37 architecture that powers today's best-sellers. Ciro Possobom, president of Volkswagen Brazil, emphasizes that this evolution will enable seamless integration of advanced electrification without reinventing the wheel—pun intended.

Why start with hybrids over full electrics? Alexander Seitz, chairman of Volkswagen Latin America, puts it bluntly: "Hybrids will be our future. The 100% electric car will not be the primary solution." In a market where charging infrastructure lags, hybrids deliver real-world flexibility. Mild hybrids assist the combustion engine for efficiency gains without propulsion duties, keeping costs down. Full hybrids take it further with electric-only modes, while plug-ins offer outlet recharging and extended range—perfect for Brazil's diverse terrains.

And here's the Brazilian twist: all these hybrids will be flex-fuel, running smoothly on ethanol or gasoline. This isn't optional; it's essential for a country leading in biofuels.

Fueling the Future with R$2.3 Billion in BNDES Backing

The announcement came amid high-profile fanfare on October 31, during Vice President Geraldo Alckmin's tour of the ABC factory. Alckmin hailed it as "Brazilian engineering going global," spotlighting the innovative edge of national talent.

To accelerate this vision, Volkswagen secured a R$2.3 billion credit line from the Brazilian Development Bank (BNDES). This injection targets hybrid R&D and export growth, part of a broader R$20 billion investment surge through 2028—R$16 billion earmarked for Brazil alone. Expect 21 new models region-wide, with ten already hitting streets.

Seitz underscores the human element: partnerships with Senai have trained 7,000 professionals over 52 years, and new courses now prioritize electrification. With 1,300 engineers, 750 suppliers, and R$32 billion in annual purchases, Volkswagen isn't just building cars—it's anchoring an industrial ecosystem.

Sustainability and Policy in the Spotlight

Volkswagen's green credentials shine bright: carbon neutrality by 2050, zero-waste operations in Brazil, and a switch from natural gas to biomethane. Yet, challenges loom. Possobom raised alarms over the proposed Selective Tax (the so-called "sin tax"), noting vehicles already face a 40% burden. "If taxes decrease, it will help us sell more," he argued—a pragmatic call for policies that boost volume and accessibility.

BNDES President Aloízio Mercadante echoed the hybrid enthusiasm: "The future is neither fossil nor electric; it is hybrid." He positioned the auto industry as pivotal to Brazil's reindustrialization, fueling jobs from suppliers to services.

The Road Ahead: Innovate or Idle?

Volkswagen hasn't named the debut hybrid model—rumors point to a mild hybrid entry, mirroring Fiat's playbook for affordability. But the potential is electric (literally). Imagine fleets of flex-fuel plug-ins slashing urban emissions while ethanol keeps rural routes viable. This hybrid strategy sidesteps EV pitfalls like battery costs and grid strain, offering a bridge to tomorrow.

Proactive move: If you're in engineering or supply chains, upskill in electrification now—Senai partnerships are expanding. Policymakers, take note: easing tax loads could unleash export booms. Volkswagen is betting big on hybrids as the smart, scalable path. Will competitors follow, or will Brazil lead the charge? This strategic shift positions Volkswagen as a leader in sustainable mobility Brazil, blending Brazilian engineering with global innovation for reduced emissions and fuel efficiency.

Stay tuned for updates as these models materialize. What's your take—ready to go hybrid? Share your thoughts; let's keep the conversation rolling.—A.d.S. for iMB.Solutions Ltda.

Renault Teams Up with Geely in Brazil: A Bold Move into Greener Rides

If you're keeping an eye on the shifting gears of the global car industry, buckle up—this one's got some real momentum. Renault just handed over a 26.4% slice of its Brazilian operations to China's Geely, and it's not just a paperwork shuffle. This partnership is primed to shake up the roads down south with more electric and hybrid options. Let's dive into what this means and why it could supercharge growth for both players.

Picture this: Geely Holding Group and Geely Automobile Holdings now have a front-row seat to Renault's setup in Brazil. They're gaining access to key resources, including the chance to roll out Geely-branded vehicles right alongside Renault's at the Ayrton Senna Industrial Complex in Paraná. That's no small feat—think shared assembly lines humming with innovation, blending French flair with Chinese efficiency.

But Renault isn't sitting idle. They're tapping into Geely's advanced platform tailored for electric and hybrid powertrains. The goal? Ramp up their lineup of zero- and low-emission vehicles tailored for Brazilian drivers. And get this: Renault do Brasil is stepping up as the official distributor for Geely Auto's eco-friendly portfolio in the country. We're talking expanded sales channels, smarter financing options, and beefed-up services that could open doors to untapped customer bases.

Proof it's already in motion? The Geely EX5 electric SUV is hitting the streets now, sold through Renault's dealership network. If you're in Brazil and eyeing a sleek, battery-powered ride, your local Renault spot might just have what you need.

This isn't the first rodeo for these two. They've already joined forces on projects like pumping investment into Renault Korea and launching Horse Powertrain, a specialist in next-gen engines. It's a pattern of smart collaboration that's building steam globally.

Financial details? Mum's the word for now—no numbers spilled. But here's my take: In a world racing toward sustainability, this deal positions both companies to lead rather than chase. Renault strengthens its green credentials in a massive market like Brazil, while Geely expands its footprint without starting from scratch. Win-win, right?

What do you think—ready to see more cross-continental car magic? If this sparks ideas for your own business ventures or just gets you excited about the future of driving, drop your thoughts below. Let's keep the conversation rolling! Who's next in line for a game-changing partnership? Stay tuned, and drive safe out there.—G.F. for iMB.Solutions Ltda.

Stay safe on your project trail! Subscribe with your email!

Ups & Downs

The Brazilian business confidence index, measured by the FGV, rose by +0.5 points in September after three consecutive negative months, reaching a total score of 89.9 points. This is generally seen as a positive sign, but still not enough to really break the negative trend. The index rose again in October. It is still too early to say whether the negative trend has really been broken.

Brazilian aircraft manufacturer Embraer achieved a new order record in the third quarter of 2025. The order backlog now stands at USD 31.3 billion, 38% above the previous year's level in 2024. Compared to the second quarter of 2025, the order backlog increased again by +5%. In the third quarter of 2025, Embraer delivered a total of 62 aircraft, representing an increase of +5% compared to the same period in 2024 and a slight increase compared to the second quarter of 2025.

The Brazilian textile industry was the sector that announced the most new products in 2025. In September 2025, an increase of 83% was recorded compared to the previous month of August 2025, as well as an increase of 18% compared to the same period in 2024. Across the entire industrial sector, new product announcements in September fell by 25.5% compared to August 2025. Compared to September 2024, there was even a decline of -40%.

Vehicle sales in Brazil reached 243,300 new vehicles in September 2025, an increase of 3% compared to September 2024. This includes private vehicles, light transport vehicles, trucks, and buses. Compared to August 2025, sales rose by +8%. Accumulated for the year 2025 to September, total sales to date amount to 1.9 million new vehicles, representing an increase of +2.8% compared to the same period in 2024.

Brazilian supermarket sales increased by +2.8% in September 2025 compared to September 2024. Compared to the previous month of August 2025, a decline of -0.94% was recorded.

Brazilian mechanical and plant engineering invoiced a total of USD 5.44 billion in September 2025, representing growth of +11.2% compared to the same period in 2024. The robust increase can be explained by the rise in investment in capital goods in Brazil and the strong increase in exports. The sector was threatened with massive losses due to the 50% tariffs imposed by the Trump administration, but was able to tap into new markets with extreme flexibility and agility.

Cost reduction is the main reason why Brazilian companies are increasingly demanding electric vehicles for their fleets. As a result, 47% of all national companies already have more electric vehicles in their fleets than vehicles with traditional combustion engines. 54% of all companies say they want to continue expanding their electric fleets over the next three years.

Sales of new private real estate in the city of São Paulo fell by 19% in September 2025 compared to September 2024, reaching a total of approximately 8,000 units sold. However, new construction projects increased by 3.7%, accumulating a sales inventory of 9,300 apartments and houses. In the last 12 months, sales increased by +19% to a total of nearly 110,000 units. New construction projects in the last 12 months increased by 37% to a total of 124,300 units.

In the third quarter of 2025, the Brazilian retail sector recorded a decline of -0.5% compared to Q3 2024. Compared to the second quarter of 2025, sales fell by -0.2%. In a month-on-month comparison of September vs. August 2025, sales increased by +0.5%.

The private consumer index in Brazil fell by -0.5% in October 2025 compared to September 2025, adjusted for inflation. This is the third consecutive decline. However, the private consumption index remains positive and points to strong Christmas sales.

One stop subscription. If you don´t like it, unsubscribe with one smash!

News from iMB.Solutions

Ignite Your Global Growth: Discover the OneBizTutor® Revolution!

What if you could shatter barriers to international expansion, slash costs by up to 700%, and accelerate your strategic breakthroughs by 70%—all while harnessing cutting-edge, real-time intelligence? At OneBizTutor®, we're not just consulting; we're your hybrid business intelligence engine, propelling businesses into uncharted territories with unprecedented speed and precision. Launched on August 27, 2025, we've already ignited six transformative projects in under three months. This isn't luck—it's proof that innovation wins. Stay tuned as we unveil why forward-thinking companies from Europe to Brazil are flocking to us. Let's turn your ambitions into unstoppable momentum!

A Spectacular Launch: From Zero to Global Hero in Record Time

Imagine debuting a game-changing service and watching it explode onto the scene. That's our story! Since day one, OneBizTutor® has secured six active projects, far exceeding our boldest projections. We're thrilled, motivated, and ready to fuel your success next.

50% from German-Speaking Europe: Resilient medium-sized enterprises eyeing Brazil as their next conquest. These newcomers are leveraging our engine to navigate market entry with laser-focused strategies.

50% from Brazil: A dynamic mix—including one agile start-up and two legacy family businesses undergoing generational shifts. They're crafting fresh business models to dominate new arenas.

Why us? Because OneBizTutor® delivers affordable excellence, blazing speed, and living intelligence that evolves with your needs. Let's dive into the magic!

The OneBizTutor® Edge: Why Settle for Outdated When You Can Dominate?

Traditional consulting? It's like driving a vintage car in a hyperloop world—reliable once, but now obsolete. OneBizTutor® redefines the game. Here's how we're empowering our clients to outpace, outsmart, and outperform:

Price That Powers Possibilities Slash your consulting budget by 6–7 times! Yes, you read that right. Legacy firms drain resources with bloated fees; we deliver premium value at a fraction of the cost. Invest the savings in growth—hire talent, innovate products, or expand markets. Pro tip: Redirect those funds to a Brazilian market scout team and watch ROI soar!

Speed That Sparks Breakthroughs Achieve robust, actionable results up to 70% faster. No endless meetings or delayed reports. Our hybrid engine crunches data, models scenarios, and delivers insights at warp speed. German firms entering Brazil? They're market-ready in weeks, not months. Brazilian families pivoting generations? New models deployed before competitors blink.

Dynamic Intelligence That Never Sleeps Forget static PDFs gathering dust. OneBizTutor® provides extremely up-to-date, dynamically updated information via modular services. Markets shift? Regulations change? Pull the latest data anytime. It's like having a crystal ball fused with AI—predictive, adaptive, and always one step ahead.

Real Talk from the Frontlines: Our Brazilian start-up client? They're scaling a disruptive model with real-time competitor analytics. A German medium-sizer? They've validated entry strategies with live economic feeds, dodging pitfalls that sink 80% of newcomers. Humor break: Traditional consulting is like faxing battle plans in a drone war—charming, but you'll lose!

Your Turn to Triumph: Let's Co-Create Your Success Story

We're not just a service; we're your strategic ally in a borderless world. Whether you're a European powerhouse eyeing Latin America or a Brazilian innovator ready to reinvent, OneBizTutor® equips you to win big, fast, and affordably.

Proactive Next Step: Reply to this newsletter or visit onebiztutor.com (placeholder—claim your domain!) for a complimentary strategy audit. Tell us your vision—market entry, generational pivot, or beyond—and we'll prototype a tailored OneBizTutor® module in 48 hours. No obligations, just pure potential.

Opinion Alert: In today's volatile economy, hesitation is the real competitor. Companies clinging to legacy consulting are yesterday's news. Join the OneBizTutor® vanguard—innovate outside the box, dominate dynamically, and let's build empires together!

Fueled by your success, The OneBizTutor® Team Hybrid Intelligence. Human Ambition. Infinite Growth.

P.S. Spot a fellow leader who needs this edge? Forward this now—let's spark a global chain reaction!

Exciting Horizons: Our Newsletters Are Powering Ahead – Join the Momentum!

Dear Valued Readers and Future Subscribers,

stay tuned, because the future of insightful B2B content is accelerating faster than ever – and you're invited to lead the charge! At [Your Company/Brand], we're not just publishing newsletters; we're engineering gateways to innovation, strategy, and real-world triumphs. Our latest metrics aren't mere numbers – they're proof that proactive minds like yours are fueling a revolution in digital intelligence. Let's dive into the wins, unpack the opportunities, and chart a bold path forward. Your engagement is the spark – let's ignite it together!

GreyRhino: The Unstoppable Flagship Roaring Past 15,000 Subscribers

Imagine a beacon of foresight cutting through the noise of uncertainty – that's GreyRhino, our flagship powerhouse, now boasting over 15,000 loyal subscribers! This isn't luck; it's the result of delivering razor-sharp insights that empower leaders to spot risks and seize opportunities before they trend.

Direct Digital Dominance: A whopping 83% of editions beam straight from our website into inboxes, ensuring seamless, uninterrupted value.

Channel Evolution: The remaining 17% flow primarily through our Substack digital newspaper and LinkedIn. (Pro tip: While LinkedIn's relevance has dipped over the past 18 months, we're pivoting smarter – think AI-driven discovery!)

AI-Powered Growth Engine: Nearly 50% of new subscribers discover us via generative AI web browsers. Talk about thinking outside the box – or should I say, outside the algorithm?

Steady, Sustainable Surge: We're welcoming ~2% new subscribers monthly, with active readers jumping ~4% each month. Consistency meets exponential potential!

Engagement That Shatters Benchmarks: An astonishing 54% of subscribers devour every word – a B2B rarity that screams "must-read" status.

Opinion Alert: In a world drowning in content fluff, GreyRhino's full-read rate isn't just impressive; it's a clarion call for quality over quantity. Why settle for skims when you can master the full narrative? Solution: Subscribe today and elevate your strategic edge – click [Subscribe to GreyRhino] to lock in your spot in this elite community.

CyberSynth Circular: The Agile Sprinter Redefining Digital Navigation

If GreyRhino is the wise elephant in the room, CyberSynth Circular is the sleek racehorse galloping through the hybrid digital-real world nexus! Tailored for trailblazers who crave effortless online mastery and offline agility, this newsletter is capturing hearts (and minds) at breakneck speed.

Subscriber Sprint: Approaching 2,500 subscribers and climbing – nearly 90% delivered directly via our website for that premium, personalized touch.

Substack's Rising Star: This channel is exploding in relevance, outpacing others with rapid growth.

LinkedIn's Fade-Out: Always a lighter contender, it's continuing to wane – but who needs it when direct and Substack are thriving?

Hyper-Growth Mode: A jaw-dropping ~15% monthly increase in new subscribers. Momentum? We've got it in spades!

Readability Royalty: Over 60% full-read rate – because who wouldn't binge on content this electrifying?

Humorous Aside: Navigating the digital jungle while dodging real-world potholes? CyberSynth Circular is your GPS with a sense of humor – no wrong turns, just winning routes! Proactive Innovation: We're exploring AI-curated personalization next. Imagine editions tailored to your hybrid challenges. Clear Call to Action: Don't lag behind – subscribe now at [Subscribe to CyberSynth Circular] and turbocharge your dual-world dominance.

Portal MiD48: Our Bold New Venture into Brazilian Family Business Excellence

Fresh off the launch pad: Portal MiD48, our newest family member, laser-focused on empowering Brazilian family enterprises. Published entirely in Portuguese, it's a cultural bridge to sustainable success in one of the world's most dynamic markets.

Details are under wraps for now – it's that new and exciting! But rest assured, we're applying the same growth alchemy that supercharged our flagships. Outside-the-Box Tease: Picture AI-infused strategies meeting time-honored family legacies. The potential? Limitless.

Motivating Challenge: Brazilian innovators, this is your portal. Stay tuned for updates, or better yet, be a pioneer – express interest at [Contact for Portal MiD48] and shape its evolution with us.

Why This Matters – And How You Can Amplify the Impact

These milestones aren't endpoints; they're launchpads. With AI browsers driving half our influx and read rates defying industry norms, we're proving that solution-oriented content works. My Strong Opinion: In B2B, engagement isn't optional – it's the competitive moat. We're building it brick by insightful brick.

Proactive Solutions to Supercharge Your Experience:

Refer a Colleague: Unlock exclusive previews – growth loves company!

Feedback Loop: Reply with your top challenge; we'll feature solutions in upcoming editions.

Cross-Subscribe: Bundle GreyRhino and CyberSynth for a 360° intelligence upgrade.

Innovate With Us: Suggest AI integrations or topics – let's co-create the future.

We're talkative by design because dialogue drives progress. What's your take on these surges? Hit reply – let's converse, collaborate, and conquer.

Onward to even greater heights, [Your Name/Team] [Your Company/Brand] P.S. Subscriber growth at 2-15% monthly? That's not statistics; that's your invitation to join a movement. Subscribe across all channels today and let's make waves! 🚀

Get Out

The Soulful Slow Down: Three Days of Wine and Wonder in Uruguay

Frank P. Neuhaus, Nov. 9th, 2025

In our digital, dizzying age, have you ever felt the subtle tug of something slower, something real? A call to stop chasing the next click and instead savor the present moment, perhaps with a glass of world-class wine in hand?

If so, I want to take you by the hand and lead you to Uruguay. This small, wonderful nation tucked away in South America deserves to be explored at a leisurely pace. With a geographical location and climate that gift the world with spectacular wines, Uruguay is the perfect spot for the soul that hasn't lost sight of the beautiful, tiny details.

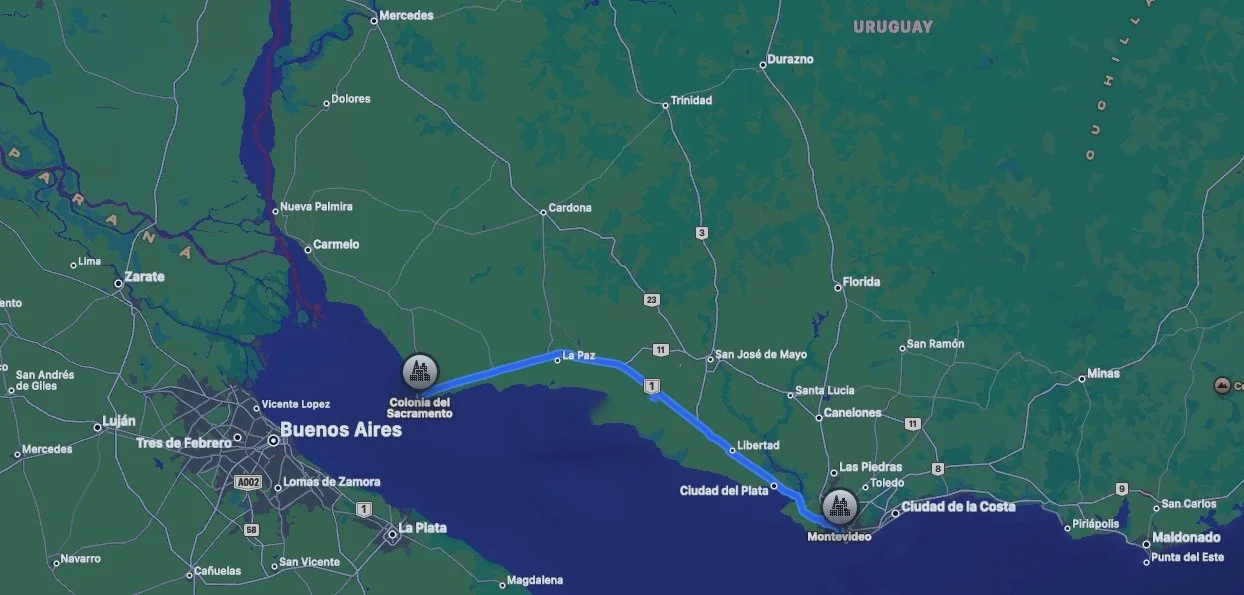

If you’re passing through—on a business trip or traveling between the bustling hubs of São Paulo and Buenos Aires—consider this your gentle nudge. Take a long weekend, make a stopover in Montevideo, and join me for a tour that weaves together culture and countryside, history and harvest, from the capital to the charming streets of Colonia de Sacramento.

Montevideo, Uruguay

Day One: Montevideo’s Quiet Rhythm

Montevideo is a city resting comfortably with one foot in the past and one in the present. It’s unhurried, offering a treasure trove of quiet cafés and stellar restaurants, all proudly featuring their national wines.

Start your morning in the historic center. Wander through art galleries, take in the grandeur of the Solis Theater, and pay homage to national hero José Artigas in Independence Square. After your walk, the Mercado del Puerto beckons with its vibrant atmosphere.

A Story to Remember: If you’re moved by true stories that echo far beyond their moment, be sure to visit the Andes 1972 Museum (mandes.uy). It offers a detailed look at the Uruguayan rugby team's plane crash in the Andes—the very story that inspired the powerful Netflix film, Society of Snow.

For lunch, I highly recommend finding your way to Hugo Soca Cocina Casera. Hugo Soca is a national icon, and in a stately house painted in Uruguay’s colors, he lovingly reinvents traditional dishes using only seasonal, local ingredients. Ask the waiter for a wine pairing—you won't be disappointed (a reservation is best!).

As the afternoon light softens, it’s time for true tranquility. Grab a taxi—don’t worry, the drivers here are famously fair—and head about 40 minutes out of the city to the Canelones region for your first bodega visit. My personal recommendation is Bodega Pizzorno, a winery that has been producing since 1910. Here, you can truly unwind and stay the night. For $310 USD for two people, you get lunch, breakfast, a bottle of wine, a guided tour, and a master class. It’s the perfect, peaceful start to your journey.

Day Two: Classic Cars and Slow Travel

The drive from Montevideo to Colonia de Sacramento is only about two hours, but let’s take it slow.

Our first stop, about 30 minutes outside the capital, is Bodega Bouza. This boutique winery, known for its award-winning bottles, was one of the pioneers of wine tourism in the country. What truly sets it apart? Your tasting takes place in a large garage surrounded by a stunning collection of wonderful old cars. You’ll sample four wines paired perfectly with local cheeses and breads as you soak in the appealingly unique setting.

Further on the road to Colonia, we’ll make another fascinating stop at Comarca Las Liebres. This is where the concept of slow travel truly comes alive. Combining an elegant wine tourism project with gastronomy and exclusive accommodation in just four suites, it is a place designed to help you disconnect.

Housed in a 1920s mansion, the restaurant’s recipes are inspired by Uruguayan home cooking and change with the seasons. Before your meal—lunch, afternoon tea, or dinner—stroll through the huge organic garden. Meals start around $45 per person with a glass of wine, and their wine cellar features bottles prepared exclusively for them, like their Lebratoblend.

To truly embrace the pause, stay here overnight. The four gorgeous suites blend modernity with antique pieces (one even has a library and movie theater!). Rates start at $280 for two and include breakfast and an afternoon wine tasting. Let the quiet sink in.

Day Three: Colonia’s Cobblestones and Carmelo’s Charms

Colonia de Sacramento is a picture-book town of colorful, old houses and cobblestone streets. Before you head to the vineyards, give yourself the gift of a simple stroll. Find the iconic Calle de Los Suspiros (Street of Sighs), climb the Lighthouse, and walk along the Rambla.

The Colonia department boasts at least 13 wineries. If you want to keep close to the city, you have excellent options less than a 40-minute drive away, including El Legado, Narbona, and Los Cerros de San Juan.

Los Cerros de San Juan is a must-see. With historic buildings dating back to the mid-19th century, it’s considered Uruguay's first winery and is now a National Historic Landmark. A guided tour with tasting, plus samples of their olive oil and sheep cheese, averages $35.

If you have that extra spark of energy, I encourage you to extend your journey about 40 minutes further to Carmelo. Here you'll find El Legado, a beautiful boutique winery run by a friendly family. You get a close look at the high-quality, artisanal production model, right down to the manual labeling. Lunch with a tour and wine pairing starts at $65.

Finally, for a complete immersion, you could visit Narbona Wine Lodge. This spot combines a winery, inn, and farm right on the banks of the Rio de la Plata. Their vineyards are robust, featuring favorites like Pinot Noir, Syrah, and exclusive hectares of Tannat, Uruguay’s signature grape.

From Colonia del Sacramento, your beautiful journey can continue with a 90-minute ferry ride to Buenos Aires, or you can simply take the memories of your slow, soulful escape back home.—F.P.N. for iMB.Solutions Ltda.

Montevideo to Colonia del Sacramento

Contact

You want to subscribe to the newsletter? OK, take your smartphone and scan the QR code!

Discover What Matters Most to You—Backed by 140+ Project Missions!

Curious about the impact of our insights at iMB.Solutions? We put our articles, blogs, and case studies to the test—running three independent AI-driven queries with Perplexity, Google Gemini, and Mistral. The result? A powerful keyword cloud reflecting the topics that truly resonate.

Do you see yourself in these trends? Let’s connect and explore how our expertise—shaped by 140+ project missions over two decades—can drive your success.