GreyRhino newsletter Edition December 2025

Discover the GreyRhino Newsletter by iMB.Solutions!

Stay ahead of the curve with the GreyRhino newsletter, your go-to source for insightful analysis and expert commentary straight out of the project missions. Curated by iMB.Solutions, this newsletter dives deep into the "grey rhino" events—highly probable, high-impact threats that we often overlook.

Why Subscribe?

Expert Insights: Gain access to Frank P. Neuhaus's unique perspectives and in-depth analysis on global risks and opportunities.

Timely Updates: Stay informed with the latest developments and trends that could impact your business and personal life.

Actionable Advice: Learn practical strategies to navigate and mitigate risks, ensuring you're always prepared for what's next.

Join a community of forward-thinking professionals who are committed to staying informed and proactive. Don't miss out on the valuable knowledge and insights shared in the GreyRhino newsletter.

📥 Subscribe now on iMB.Solutions webpage and turn potential threats into opportunities!

Sign up with your email address to receive news and update!

Prime Story

Brazil's Data Center Gold Rush: The US$ 12 Billion Race to Build Latin America's Digital Backbone

At iMB.Solutions, we drive two key project missions for clients supplying core technology and services to Brazil's data center industry, granting us unparalleled insights from the sector's explosive growth and fresh investments like Microsoft’s $2.7B and AWS’s $1.8B commitments. This hands-on immersion reveals critical questions around energy pricing and renewable sources, where Brazil's 88% clean grid at ~$0.16/kWh emerges as a game-changer amid surging AI demands projected to hit 13.2GW by 2035. Our deep dive equips stakeholders to harness this renewable edge, powering sustainable data hubs without nuclear's pitfalls.

In the heart of the Southern Hemisphere, Brazil is quietly positioning itself as a powerhouse in the global digital economy. What was once a market primarily consuming digital services has transformed into a critical hub for hosting them. Fueled by the explosive growth of Artificial Intelligence (AI), the widespread shift to cloud computing, and the urgent need for low-latency data processing, Brazil's data center sector is entering a phase of hyper-growth. This surge is not just reshaping the nation's infrastructure but also attracting billions in investments from tech giants and infrastructure leaders alike.

For stakeholders—from investors to policymakers—the message is resounding:

Brazil is no longer on the periphery of the digital revolution. It's at its epicenter, building the backbone that will support Latin America's tech future and beyond.

The Catalyst: REDATA and the Surge of Investments

The Brazilian data center market was already expanding organically, but the federal government's introduction of REDATA (Special Tax Regime for Data Center Services) has ignited an unprecedented investment boom. Set to take effect on January 1, 2026, REDATA is a strategic initiative aimed at dismantling the high capital expenditure (CAPEX) barriers that have historically hindered the development of world-class digital infrastructure.

This regime is a game-changer, offering targeted incentives to accelerate construction and operations. Key highlights include:

Tax Suspensions: Federal taxes such as PIS/Cofins and IPI are suspended on the domestic acquisition and importation of essential IT equipment, including servers, electronic components, and other critical hardware.

Projected Economic Impact: According to industry associations and government projections, this could unlock up to R$ 60 billion (approximately US$ 10.8 billion) in new investments by 2026/2027, supercharging the sector's expansion.

Promoting Decentralization: While São Paulo continues to dominate as the primary hub—handling 70-80% of current data traffic—REDATA encourages the creation of new "Edge data centers" in underrepresented regions like the Northeast Brazil and South Brazil. These facilities will support decentralized applications requiring ultra-low latency, such as real-time AI processing and IoT networks.

This policy isn't just about tax breaks; it's a deliberate effort to position Brazil as a competitive player on the global stage, drawing in hyperscalers and fostering a more resilient national digital ecosystem.

The Core Drivers: AI, Cloud Migration, and Beyond

The data center construction frenzy in Brazil isn't built on speculation—it's a direct response to surging demand that's already straining existing capacity. Several interlocking factors are propelling this growth:

The AI Explosion: The rise of Generative AI models demands immense computational power, advanced cooling systems, and vast energy resources. Global hyperscalers like Google, AWS, and Microsoft are aggressively securing land and power contracts in Brazil to localize these workloads, reducing reliance on distant servers and cutting costs.

Data Sovereignty and Latency Requirements: As Brazil's financial, governmental, and industrial sectors accelerate digital transformation, regulations mandating data storage within national borders (to ensure sovereignty) are becoming stricter. Coupled with the need for millisecond-level processing in applications like online banking and e-commerce, this is compelling tech companies to invest in local infrastructure.

The Green Energy Edge: Brazil’s renewable energy grid stands out with an impressive 88% renewable energy mix in 2024, primarily from hydro, wind, and solar sources. This not only offers affordable power—averaging around $0.162/kWh for residential users—but also appeals to ESG-focused investors. Tech giants are drawn to this sustainable advantage, enabling them to decarbonize operations without the environmental or regulatory hurdles associated with fossil fuels or nuclear power.

Recent commitments underscore this momentum: Microsoft has pledged $2.7 billion, while AWS is investing $1.8 billion in Brazilian data centers. Projections indicate AI-driven demand could reach 13.2 GW by 2035, with data centers expanding by 1,800 MW by 2030 alone. At iMB.Solutions, our hands-on involvement in supplying core technologies and services to this industry provides unique insights into how Brazil's renewable energy prowess is addressing critical questions around energy pricing and sustainability.

Bridging the Infrastructure Gap - The "Brains" Behind the Boom

Beyond the flashy servers and fiber-optic cables, the real challenge lies in the operational infrastructure that ensures data centers run flawlessly. Modern facilities are engineered for 99.999% uptime, functioning as fortified hubs that demand sophisticated monitoring and control systems—often referred to as the "Central Nervous Systems" of the operation.

This has sparked a parallel market for critical monitoring tools:

Visualizing Operational Complexity: Data center operators are inundated with metrics, from thermal readings and power load balancing to physical security footage and cyber threat alerts. Advanced visualization tools are essential for managing this deluge.

The 24/7 Imperative: As facilities scale up, the demand for professional-grade Network Operations Centers (NOCs) and Security Operations Centers (SOCs) has exploded. These control rooms feature industrial video walls and integrated software designed for decade-long reliability, allowing teams to detect and respond to issues in real time.

Converging Security Threats: With physical intrusions and cyberattacks increasingly intertwined, new data centers are adopting "Fusion Centers." These integrated spaces combine physical security monitoring with cybersecurity defenses, creating a unified operational environment.

Without these systems, even the most advanced hardware risks failure, highlighting the need for investments in operational intelligence alongside physical builds.

Global Power Scorecard: Why Brazil's Renewables Outshine Nuclear Alternatives

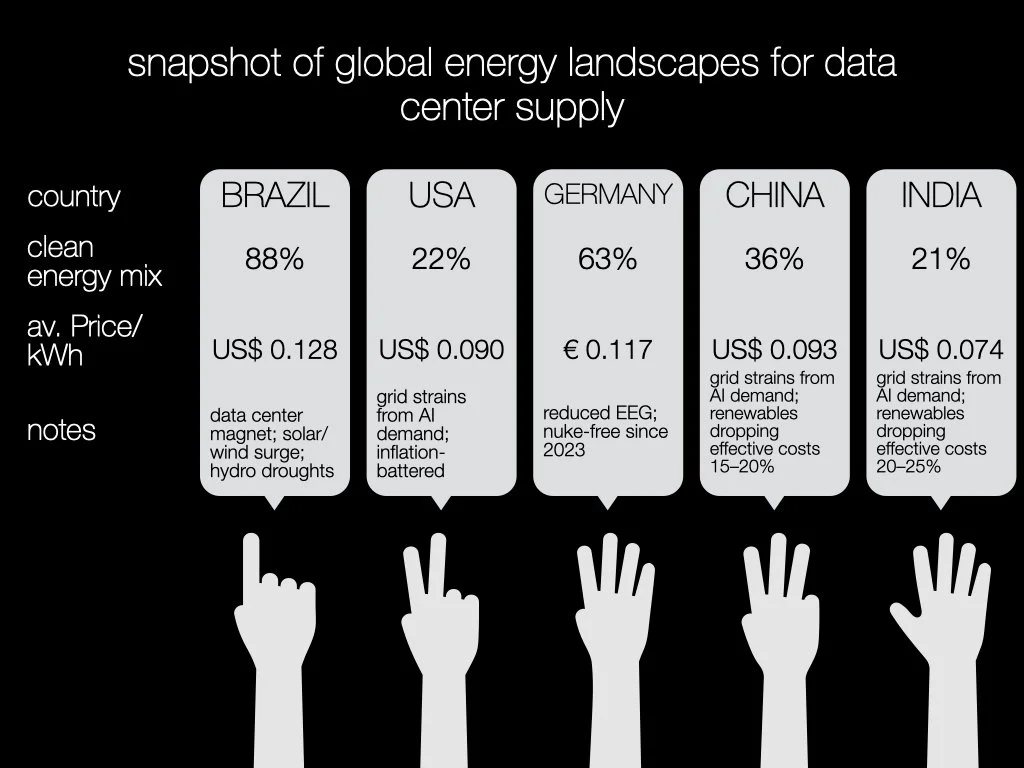

Brazil's renewable energy triumph is a key differentiator in the global data center race. While some nations chase a "nuclear renaissance," Brazil demonstrates that renewables offer faster deployment, lower costs, and fewer risks. Here's a comparative snapshot of global energy landscapes for data center supply in 2025:

source: international strategic investor in data centers, Brazil, December 2025

Germany's nuclear phase-out in April 2023 shifted focus to renewables, despite occasional price volatility. China leads in reactor construction but grapples with waste management, while India's solar additions hit 24 GW in fiscal 2025.

Why Brazil's Renewables Crush Nuclear Hype

Brazil's model proves renewables are superior for scaling data centers sustainably:

Hydro Dominance: Facilities like Itaipu provide instant, scalable power without meltdown risks or massive overruns (nuclear projects often exceed $20 billion). Hydro also aids in natural cooling for data centers.

Solar Surge: Projections for 2025 show +19.2 GW in capacity, with 127% growth in key metrics. Solar deploys in months via AI-optimized Power Purchase Agreements (PPAs), far outpacing nuclear timelines.

Wind Reliability: 35% cheaper than offshore alternatives, wind ensures consistent 24/7 uptime. In August 2025, combined solar and wind reached 34% of Brazil's energy share.

Cost Transparency: Renewables avoid hidden expenses like waste storage (a global €50 billion+ unsolved issue) or uninsurable risks. Uranium prices rose 22% from 2020-2025 in Brazil, versus 35% in the USA.

Job Creation Boom: The sector has generated 1.2 million green jobs, now intersecting with AI tech demands—nuclear options lag with outdated infrastructure.

This renewable foundation shields Brazil from U.S.-style blackouts or China's coal dependencies, making it a prime destination for hyperscalers' $3 billion+ investments in 2025.

The Outlook 2026 and Beyond

The coming 24 months will separate the leaders from the laggards in Brazil's digital infrastructure race. With REDATA alleviating financial hurdles, the focus shifts to physical constraints: securing land near high-voltage grids and assembling skilled teams to manage these intricate operations.

Brazil isn't just constructing data centers—it's forging the digital foundation for an entire continent. The R$ 60 billion investment wave demands not only concrete and silicon but also robust command-and-control systems to maintain reliability amid growing complexity.

Key Takeaways for Stakeholders

Seize the Regulatory Window: Leverage REDATA incentives from Q1 2026 to minimize CAPEX and accelerate projects.

Prioritize Operational Intelligence: Move beyond basic construction to invest in NOCs, SOCs, and fusion centers for unmatched uptime and security.

Explore Regional Opportunities: Venture outside São Paulo into emerging Edge hubs in the Northeast and South Brazil for diversified, low-latency growth.

Action Plan - Harness Brazil's Renewable Model for Success

To capitalize on this boom, stakeholders should adopt a proactive strategy inspired by Brazil's successes:

Audit Energy Bills: Use ANEEL tools to identify solar payback periods as short as four years.

Join Cooperatives: Access 35% discounts on wind and solar through co-ops.

Optimize Usage: Shift to off-peak hours for up to 62% savings.

Build Skills: Train via SENAI programs for green-AI careers.

Advocate for Incentives: Push for expanded ReData policies to achieve 100% renewable data hubs.

As countries like Chile and Australia emulate Brazil's approach, this renewable-fueled AI surge offers a global blueprint: clean, abundant energy powering sustainable innovation without nuclear's drawbacks. The future of data centers is here—and it's green.

Sign up with your email address and smash the subscribe button!

The LatAm Story

Argentina’s Financial Nightmare: Spanish Banks Slam the Brakes While Families Drown in Debt

Buenos Aires, Dec. 13th, 2025

Let’s call it what it is: Argentina is not “adjusting.” It is collapsing under the weight of decades of populist mismanagement, with no fundamental change until now, and the two largest Spanish banks operating in the country—BBVA and Santander—have just sent the clearest distress signal yet. They are not merely “prudent”; they are in full retreat mode, slashing credit lines, stockpiling provisions, and openly admitting that lending money to Argentines has become a losing proposition. When even foreign banks that have weathered countless Latin American crises start running for the exits, you know the patient is critical.

Buenos Aires, Argentina - Q4 2025

The Banks Speak the Truth the Government Won’t

BBVA’s own research department didn’t mince words: “The economic growth outlook has deteriorated… as a result of political uncertainty, high interest rates, and exchange rate pressures.” Translation: The Milei experiment is delivering chaos instead of the promised stability, and nobody knows what tomorrow’s dollar or next week’s policy will look like.

Santander’s CEO Héctor Grisi was even more blunt: “With real interest rates at these levels, it is impossible to make money.” Rates touched 60% in October—yes, sixty percent. At that cost, only dollar-earning exporters or energy giants can possibly service debt. Everyone else—regular companies, small businesses, and especially families—are being priced out of the credit market altogether.

The numbers are brutal:

BBVA’s loan book in Argentina shrank 9% in a single quarter.

Santander now only lends to “dollar-exporting and energy companies.” Everyone else? Good luck.

Cost of risk exploded to 4.91% at BBVA and a staggering 7% at Santander.

Santander lost €348 million in the first nine months of the year in its Argentine unit. BBVA barely scraped €13 million in profit for the third quarter—down 25% year-on-year.

These are not cautious adjustments. This is two sophisticated European banks voting with their balance sheets: Argentina is unlendable.

The Silent Debt Bomb Under Every Argentine Roof

While politicians argue about fiscal surpluses on television, the Central Bank quietly released data that should terrify any responsible observer. The average Argentine household now owes 5.6 million pesos—up 75% in just one year. That is not “access to credit.” That is desperation dressed up as consumption.

And they are defaulting at a frightening pace:

Household delinquency tripled in twelve months.

One out of every fourteen pesos owed is already in arrears.

Fintech and digital wallets? 20–25% default rates.

Financing for basic household appliances? A staggering 27% in arrears.

Think about that: Argentines are so broke they are financing refrigerators and washing machines at rates that would make a loan shark blush—and then defaulting anyway.

This is what decades of living beyond your means looks like when the music finally stops. Successive governments—Peronist and non-Peronist alike, until today—encouraged a culture of “consume now, pay never” fueled by subsidies, price controls, and endless money printing. The bill has arrived, and ordinary families are the ones who will pay it with repossessed homes, destroyed credit scores, and years of austerity they never voted for.

A Bleak Punchline

Santander says it is “waiting to see the impact of U.S. financial aid.” That’s banker-speak for “we hope someone bails us out because this country certainly can’t pay us back on its own.”

Argentina is not in a “recession.” It is in the advanced stages of a debt-deflation spiral that punishes savers, rewards defaulters, and crushes the middle class. The Spanish banks have seen enough; they are pulling the plug. The tragedy is that millions of Argentine families no longer have that luxury—they are trapped, over-indebted, and watching their future evaporate one default notice at a time.

Until Argentina confronts its addiction to living on borrowed money and borrowed time, the story will only have one ending. And it won’t be pretty.

Stay vigilant,

Your critical eye on the Pampas — TangoTech

Sign up with your email address to receive news and updates!

From the Newsroom of Industry

Brazilian Textile Industry: A Masterclass in Green Growth That the World Needs to Hear About

Good morning from a Brazil that is quietly rewriting the rules of industrial success! While much of the world still treats “growth” and “decarbonization” as a painful trade-off, the national textile sector just dropped a 24-year bombshell that deserves a standing ovation:

Between 2000 and 2024, Brazilian textile companies slashed CO₂ emissions by an astonishing 70% — while simultaneously increasing production by 18%.

Yes, you read that right. More clothes, more jobs, more value added… and a carbon footprint that shrank like a cheap T-shirt in hot water (but in the best possible way).

How on Earth Did They Do It?

This isn’t the result of magical thinking or offshore production tricks. It’s the fruit of relentless, creative, and very Brazilian ingenuity:

Energy matrix revolution: Massive adoption of hydroelectric, biomass (especially sugarcane bagasse), wind, and solar power in mills. Today, over 85% of the electricity used by the sector comes from renewable sources.

Process efficiency on steroids: Investments in new dyeing technologies that cut water and energy use by up to 50%, closed-loop water systems, and LED lighting that turned factories into something closer to spacecraft than 1990s sweatshops.

Circular economy in action: Explosion of recycled cotton and PET bottle fiber programs. Brands like Renner, C&A Brazil, Hering, and hundreds of smaller players now launch collections with 30–100% recycled content—without sacrificing quality or price competitiveness.

Supply-chain collaboration: Programs such as the Brazilian Textile Retail Association (ABVTEX) and the “Textile Pact for Responsible Production” forced (in the nicest way) the entire chain—from spinning to retail—to measure, report, and continuously improve environmental KPIs.

The result?

A sector that grew its physical output by nearly one-fifth while emitting less than a third of the CO₂ it did at the turn of the millennium. That’s not just decarbonization; that’s decoupling on a heroic scale.

Why This Matters (more than you think)

Proof that industry and climate action can be allies, not enemies

Anyone who still claims “we can’t afford to go green” should be kindly escorted to Santa Catarina or Ceará and shown the numbers.

Competitive advantage in a carbon-conscious world

Europe’s CBAM (Carbon Border Adjustment Mechanism) is coming. The USA is debating its own version. Guess who’s laughing all the way to the export bank? The Brazilian textile player whose carbon intensity is already lower than many European competitors.

Inspiration for the rest of Brazilian industry

If textiles—historically water- and energy-intensive—can pull this off, imagine what steel, cement, agriculture, and mining can achieve with the same boldness.

The Road Ahead: From Impressive to Unstoppable

70% is phenomenal, but the job isn’t done. The sector has already committed, through the “Brazilian Textile Chain 2030 Agenda,” to reach net-zero operational emissions by 2040 and full value-chain net-zero by 2050. New frontiers include:

Scaling green hydrogen pilots for synthetic fibers

Blockchain-traced regenerative cotton projects with small farmers

Carbon capture in biomass boilers (yes, negative emissions are on the menu)

Final Cheer

Brazilian textile entrepreneurs, engineers, factory workers, and sustainability teams: take a bow. You’ve shown that when creativity meets determination, we don’t have to choose between feeding families and saving the planet—we can do both, and do it better than anyone expected.

To everyone reading this outside Brazil: the playbook is public, the door is open, and the coffee is strong. Come learn with us.

Because if a middle-income country famous for soccer and samba can cut emissions 70% while growing production, imagine what the rest of the world can achieve when we finally decide to get serious.

Type your email, smash the subscribe button and get the next edition in your email inbox!

Short Cuts from Industries

Brazilian Shoppers Prioritize Price Over Brand Loyalty

Brazilians focus more on price and convenience than tradition, quality, or advertising when selecting products, with brand loyalty remaining low across most age groups except Generation Z. The EY Future Consumer Index, based on over 20,000 respondents from 27 countries including Brazil, highlights this shift toward deal-hunting and brand switching. High price awareness drives exploratory shopping, research before purchases, and growth in private labels, outpacing emerging market averages.

Low Loyalty Amid Abundant Options

Only about one-third of Brazilian consumers show loyalty to brands, influenced by diverse options across retail channels like online, in-store, and experiential touchpoints. Generation Z bucks the trend slightly with 38% loyalty, aided by tech ease, product availability, and strong communication. Compared to global averages, Brazilians report higher indifference to brands, greater openness to experimentation, and elevated use of social platforms (7 points above global) plus influencer recommendations (12 points above).

Advertising Investments Surge Despite Trends

The Cenp-Meios panel reports that 327 advertising agencies generated US$ 2.4 billion in media buys during the first half of 2025, up 12.52% or US$ 0.3 billion from H1 2024. This growth exceeds Brazil's 2.5% GDP rise for the period and anticipates stronger second-half spending around Black Friday and Christmas. Internet dominated at 40.2%, followed by broadcast TV (33.4%) and outdoor media (11.9%), with the Southeast region leading national investments at 18%.

Implications for Brands and Retailers

Cristiane Amaral, EY's lead for consumer and retail in Latin America, notes that factors like technology adoption and AI integration into social buying normalize volatility. Brands should prioritize integrated solutions delivering perceived value over traditional advertising. Amid rising consumer confidence, retailers must blend competitive pricing, variety, and seamless omnichannel experiences to foster loyalty in 2025.Brazil's employment situation has markedly improved since the pandemic, with the unemployment rate hitting a record low of 5.6% in late 2025, the lowest ever recorded. Employment stability, particularly for executives, has strengthened with hiring rates in Brazil surpassing pre-pandemic levels by 6%, and formal employment increasing while informality falls. However, some caution is warranted as job creation slowed significantly in mid-2025 and certain sectors like services show signs of cooling, indicating more competition for top executive roles. Networking is advised to navigate this dynamic job market.

Shopping Center Iguatemi, São Paulo, Brazil

Brazilian Labor Market 2025

Brazil's employment situation has markedly improved since the pandemic, with the unemployment rate hitting a record low of 5.6% in late 2025, the lowest ever recorded. Employment stability, particularly for executives, has strengthened with hiring rates in Brazil surpassing pre-pandemic levels by 6%, and formal employment increasing while informality falls. However, some caution is warranted as job creation slowed significantly in mid-2025 and certain sectors like services show signs of cooling, indicating more competition for top executive roles. Networking is advised to navigate this dynamic job market.

Employment Recovery and Stability

Brazil's unemployment rate improved from about 11-12% pre-pandemic to a historic low of 5.6% by the fourth quarter of 2025. This recovery is reinforced by a rise in the employment rate approaching or exceeding pre-pandemic levels across Latin America, with Brazil leading. Executives benefit from greater employment stability, increased formal jobs, and expanding hiring in emerging markets. Yet, job creation slowed by over 30% in the third quarter of 2025, flagging potential challenges ahead for the labor market.

Work Models: Shift Back to Office with Hybrid Flexibility

The executive market saw a dramatic rise in remote work during the pandemic, but 2025 marks a return toward presence-based roles. About two-thirds of C-level positions require in-office attendance to foster company culture, diminishing purely remote roles. Nonetheless, hybrid work remains prevalent, with approximately 7% of companies offering hybrid options and 5% purely remote, reflecting an ongoing adaptation to work-life balance demands. Companies are exploring innovative workspace solutions like flex office hubs in major cities such as São Paulo to blend creativity and networking.

Salaries, Skills, and Industry Trends

Wages have rebounded to pre-pandemic levels with real wage recovery, but growth has stabilized around 2.7% since early 2025. Demand is strong for executives in technology-driven sectors like AI, clean energy, finance, agribusiness, and HR, revealing Brazil's positioning as an innovation hub. New regulations on equal pay and digital communication are helping to make the market fairer. However, some service sectors are slowing down, so upskilling in emerging areas like AI and ESG (environmental, social, and governance) is vital to maintain competitiveness.

Brazil's employment and executive markets in 2025 are characterized by robust recovery, a pivot back to office work balanced with hybrid options, and growth in tech-related industries with steady salaries. Adaptability and proactive skill development are key for executives to thrive amid market fluctuations and increasing competition.

Avenida Paulista, São Paulo, 2025

Brazilian Optimism Soars as AI Transforms Lives and Workplaces

While much of the world debates whether AI is a blessing or a threat, Brazil has already made its choice—and it’s emphatically yes. A groundbreaking new study, "Our Life with AI: From Innovation to Application", reveals that Brazilians are not just adopting artificial intelligence; we are embracing it with a level of enthusiasm that outshines the global average. This isn’t blind optimism—it’s confidence backed by real, tangible progress.

Cristo Redentor, Rio de Janeiro, Brazil, 2025

Brazil Leads the World in AI Positivity

65% of Brazilians see AI as a powerfully positive force in life—beating the global average of 57%. Even more telling: 64% believe the benefits far outweigh the risks. That’s the mindset of a nation ready to win the future.

Where is this transformation already happening?

🔬 Science: 80% say AI is revolutionary

🏥 Medicine: 77% recognize game-changing impact

🌱 Agriculture: 74% see AI feeding the future

🔒 Cybersecurity: 67% trust AI to protect what matters

This isn’t theory. It’s happening now—and Brazilians feel it.

Work Won’t Disappear—It Will Evolve (and Pay Better)

Forget the tired narrative of “robots stealing jobs.” In Brazil, we’re writing a different story:

✅ 60%+ expect AI to increase their income and create new, better jobs (vs. only 49% globally) ✅ Trust in AI’s labor market impact jumped from 62% to 68% in just one year ✅ Fewer workers fear being forced to switch careers—down from 20% in 2023 to only 15% in 2024

That’s not fear. That’s adaptation. That’s growth.

AI: Your New Best Friend in Daily Life

We’re not waiting for the future—we’re living it:

81% use AI to search smarter

76% rely on personal AI assistants

74% lean on AI to study and learn faster

And the superstars? 85% love AI writing tools | 89% adore AI translators

From students acing exams to professionals drafting flawless reports in seconds, AI isn’t replacing human brilliance—it’s amplifying it.

The Workplace of Tomorrow? It’s Already Here

78% of Brazilian workers are already using AI on the job. And among them? A resounding 88% say AI is essential for handling complex information and sparking bold new ideas.

Productivity? Skyrocketing. Creativity? Unleashed. Competitiveness? World-class.

A Message from the Front Lines

Fábio Coelho, President of Google Brazil, sums it up perfectly:

“The survey results demonstrate Brazilians' confidence in the potential of AI to generate positive impacts in work, education and everyday life. Google is committed to supporting this journey, offering tools and resources to help Brazilians from all walks of life thrive in this new era.”

The Bottom Line: Brazil Isn’t Just Ready for AI—We’re Leading It

While others hesitate, we accelerate. While others fear change, we shape it. While others ask “What if?”, we declare “Watch us.”

The global AI revolution has a new heartbeat—and it’s beating in Portuguese.

So here’s my challenge to you, dear reader: Don’t just witness this transformation. Drive it.

Experiment boldly. Learn relentlessly. Build fearlessly.

Because the future isn’t coming to Brazil. Brazil is building the future—and inviting the world to keep up.

Onward, with optimism and code, Your fellow believer in a brighter, smarter tomorrow 🚀

#BrasilComIA #FuturoÉAgora #InteligênciaArtificial Share this newsletter with someone who needs a dose of inspiration today! 👇

Stay safe on your project trail! Subscribe with your email!

Get Out

São Paulo Emerges as a Global Powerhouse: 18th in the World's Best Cities for 2026

In a world where urban living is constantly evolving, the Brazilian metropolis of São Paulo has made headlines by securing the 18th spot in the prestigious World's Best Cities ranking for 2026, as compiled by Resonance Consultancy in their 2025 report. This achievement places it among the elite urban centers globally, outpacing cities like Hong Kong (19th), Istanbul (20th), and even Miami (26th) and Lisbon (37th), while fellow Brazilian city Rio de Janeiro lands at 42nd. London, the perennial frontrunner, claims the top position for the 11th year running. With over 400 cities boasting populations exceeding one million evaluated, this ranking highlights São Paulo's remarkable post-pandemic resurgence and its appeal as a place to visit, work, and live.

São Paulo, south district, 2025

Understanding the World's Best Cities Ranking

The World's Best Cities report, produced annually by Resonance Consultancy, assesses urban areas through a comprehensive lens known as the Place Power Score. This metric draws from hundreds of data points across more than 270 qualifying cities (those with over one million residents), incorporating both quantitative and qualitative factors. The evaluation is structured around three core pillars:

Livability: Focuses on tangible aspects like air quality, walkability, public health services, urban mobility, and overall standard of living. It also considers emerging factors such as climate resilience.

Lovability: Measures cultural vibrancy, including nightlife offerings, number of museums (with emphasis on free access), social media popularity (e.g., Instagram posts and TikTok videos), Google Trends, and cultural programming.

Prosperity: Evaluates economic indicators like GDP growth, unemployment rates, the presence of large corporations, entrepreneurial ecosystems, foreign direct investment, and business innovation.

The methodology integrates data from diverse sources, including surveys of over 21,000 people from 30 countries, social media analytics from platforms like Weibo and Xiaohongshu, and performance metrics on airport connectivity and education levels. This holistic approach rewards cities that excel in scale, visibility, and economic dynamism, which explains why megacities like Sao Paulo thrive in the rankings despite challenges in areas like air quality.

Here's a quick look at the top 25 cities for 2026:

1 London - United Kingdom

2 New York City - United States

3 Paris - France

4 Tokyo - Japan

5 Madrid - Spain

6 Singapore - Singapore

7 Rome - Italy

8 Dubai - UAE

9 Berlin - Germany

10 Barcelona - Spain

11 Sydney - Australia

12 Los Angeles - United States

13 Seoul - South Korea

14 Amsterdam - Netherlands

15 Beijing - China

16 Shanghai - China

17 Toronto - Canada

18 São Paulo - Brazil

19 Hong Kong - China

20 Istanbul - Turkey

21 Melbourne - Australia

22 Bangkok - Thailand

23 Osaka - Japan

24 Oslo - Norway

25 Stockholm - Sweden

Why São Paulo Stands Out: A City of Neon and Innovation

São Paulo's climb into the top 20 is no accident—it's a testament to its dynamic revival following the global pandemic. Often dubbed "Sampa" by locals, this sprawling city of over 12 million people has leveraged its strengths in lovability and prosperity to surge ahead. Key highlights include:

Nightlife Supremacy: São Paulo ranks #1 globally for nightlife, with neighborhoods like Vila Madalena and Baixo Augusta buzzing into the early hours. The city's bars, clubs, and live music scenes have fully rebounded, drawing both locals and tourists.

Social Media Magnet: It's a leader in Instagram posts, thanks to its photogenic cultural corridors and revitalized urban spaces. This digital popularity boosts its lovability score significantly.

Cultural Riches: The return of the Michelin Guide to Brazil has spotlighted Sao Paulo's culinary scene, with acclaimed restaurants like D.O.M., Maní, and Evvai earning stars. Luxury retail on Oscar Freire Street and major malls attract international brands, while the city boasts an impressive array of museums, many with free access.

Economic Engine: The Faria Lima district has become a hub for fintech, cloud computing, and investment firms, supported by new data centers and foreign investment. Large-scale projects, such as the modernization of Anhembi and São Paulo Expo, are enhancing the events industry. Infrastructure improvements, including linear parks and bike lanes along the Pinheiros River, contribute to better urban mobility and quality of life.

Historically, São Paulo's ranking reflects its regained global relevance, surpassing smaller, high-income cities like Zurich or Vienna that don't qualify due to population thresholds. Its entrepreneurial ecosystem and low unemployment rates further bolster its prosperity pillar.

São Paulo, central District, night vision, 2025

Comparisons: Rio de Janeiro and London

While São Paulo celebrates its 18th place, Rio de Janeiro's 42nd ranking underscores different urban dynamics. Rio excels in natural beauty and tourism but lags in prosperity metrics like economic growth and business ecosystems compared to Sao Paulo's industrial might.

At the pinnacle, London's dominance is unmatched, scoring high across all pillars: #1 in airports and large companies, with booming tourism spending ($22 billion in 2024) and tech investments. As Resonance notes, "London’s magnetic appeal continues to draw a global audience, from students and entrepreneurs to tourists and corporate titans."

Social Media Buzz: Reactions to the Ranking

The news has sparked excitement on X (formerly Twitter). Brazilian outlet g1 São Paulo shared: "SP is elected the 18th best city in the world and stays ahead of Rio, Miami, and Lisbon." User @choquei echoed the pride: "São Paulo is elected the 18th best city in the world and stays ahead of Rio de Janeiro (42nd), Miami (26th), and Lisbon (37th)." Some reactions were humorous, like @bizzleisartz: "São Paulo was elected 18 best city in the world for what am I going to enjoy." Overall, the sentiment reflects national pride, with users highlighting São Paulo's edge over other global favorites.

Final Thoughts: São Paulo's Bright Future

São Paulo's ascent to the top 20 isn't merely a ranking—it's a beacon of hope, illuminating Brazil's boundless urban potential and inspiring dreamers worldwide to reimagine what's possible in a city. With its intoxicating fusion of profound cultural heritage, pulsating economic vitality, and an unyielding spirit of innovation, Sampa beckons adventurers, visionaries, and everyday heroes to immerse themselves in its electrifying rhythm and forge their own path amid its towering ambitions. As the tides of global change propel us toward resilient, forward-thinking metropolises, envision São Paulo not just climbing higher in future rankings, but soaring as a global icon of transformation and triumph. Whether captivated by the allure of its legendary nightlife, the thrill of groundbreaking business ventures, or the awe-inspiring vastness of its horizons, Sampa stands as a powerful reminder: in the heart of this vibrant giant, your greatest story is waiting to unfold, proving that the spotlight isn't just earned—it's seized with passion and purpose.

Contact

You want to subscribe to the newsletter? OK, take your smartphone and scan the QR code!

Discover What Matters Most to You—Backed by 140+ Project Missions!

Curious about the impact of our insights at iMB.Solutions? We put our articles, blogs, and case studies to the test—running three independent AI-driven queries with Perplexity, Google Gemini, and Mistral. The result? A powerful keyword cloud reflecting the topics that truly resonate.

Do you see yourself in these trends? Let’s connect and explore how our expertise—shaped by 140+ project missions over two decades—can drive your success.