GreyRhino newsletter Edition February 2026

Discover the GreyRhino Newsletter by iMB.Solutions!

Stay ahead of the curve with the GreyRhino newsletter, your go-to source for insightful analysis and expert commentary straight out of the project missions. Curated by iMB.Solutions, this newsletter dives deep into the "grey rhino" events—highly probable, high-impact threats that we often overlook.

Why Subscribe?

Expert Insights: Gain access to iMB's unique perspectives and in-depth analysis on global risks and opportunities.

Timely Updates: Stay informed with the latest developments and trends that could impact your business and personal life.

Actionable Advice: Learn practical strategies to navigate and mitigate risks, ensuring you're always prepared for what's next.

Join a community of forward-thinking professionals who are committed to staying informed and proactive. Don't miss out on the valuable knowledge and insights shared in the GreyRhino newsletter.

📥 Subscribe now on iMB.Solutions webpage and turn potential threats into opportunities!

Sign up with your email address to receive news and update!

Prime Story

The Dragon and the Southern Cross: Inside BYD’s Industrial Siege of Brazil

Preface

The global automotive order is undergoing a fracture, and the epicenter of this shift has moved to the Brazilian state of Bahia. While North America and Europe erect tariff walls against Chinese EVs, BYD has executed a sophisticated flank maneuver in South America. By the end of July 2026, the Chinese giant aims to commence full-scale national production at the Camaçari industrial complex, a move designed to bypass protectionist barriers and challenge the decades-long hegemony of legacy automakers like Toyota and Stellantis.

A powerhouse from the East storming into one of Latin America's most dynamic markets, not with a whisper, but with a roar of electric engines and ambitious blueprints. That's exactly what's unfolding with BYD, the Chinese automaker that's turning heads – and potentially the entire Brazilian auto industry – upside down. As we kick off 2026, BYD's announcement of its most aggressive internationalization push yet, zeroing in on Brazil, feels like a shot of adrenaline for our economy. Here at The GreyRhino Newsletter, we're all about spotting those massive, charging opportunities before they trample the unprepared. So, let's dive deep into this electrifying development, analyze its ripples, and explore how it could supercharge growth for businesses, investors, and everyday drivers in Brazil.

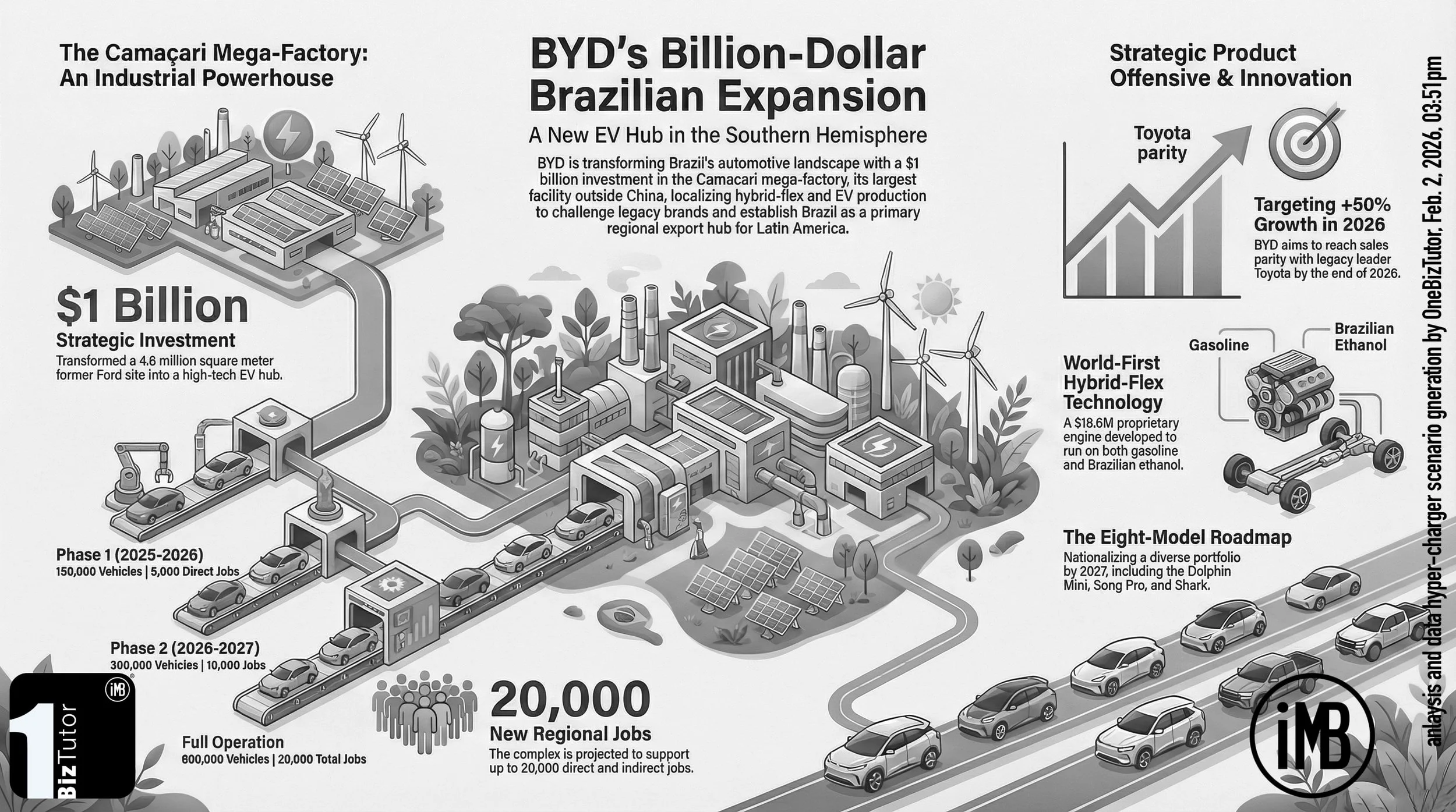

infographic generated by iMB.Solutions Ltda., São Paulo, Brazil - analysis and scenario data hyper-charger generation by OneBizTutor®, Feb. 2nd, 2026 - 03:51pm

We are excited to unpack this for you today because, frankly, it's a game-changer. BYD isn't just dipping its toes; they're plunging in headfirst with a strategy that could redefine competition in our automotive sector. We'll break it down step by step, share some forward-thinking insights, and even toss in a few proactive tips to help you stay ahead. After all, in a world where innovation waits for no one, why not position yourself as the frontrunner?

The Big Reveal - BYD's Brazilian Blueprint Takes Shape

Let's start with the facts straight from the headlines. BYD, already a global titan in electric vehicles (EVs) and batteries, has locked in Brazil as the centerpiece of its boldest expansion strategy to date. Come the end of July 2026, their state-of-the-art factory in Camaçari, Bahia, will shift into high gear with full-scale national production. This isn't some small-scale assembly line – it's a comprehensive manufacturing hub designed to churn out vehicles tailored for the Brazilian market.

The Resurrection of Camaçari

The Camaçari facility is heavy with symbolism. Built on the bones of a Ford plant shuttered in 2021—an event that signaled the retreat of Western industrial capital from the region—the site has been resurrected as BYD’s beachhead in the Southern Hemisphere.

The operational tempo is aggressive. Following the start of assembly operations in July 2025, the plant had already churned out nearly 20,000 vehicles by early January 2026. To maintain this pace, BYD instituted a second production shift in November 2025. The facility currently assembles the Dolphin Mini, King, and Song Pro, but the roadmap is far more ambitious. By 2027, the company plans to manufacture eight distinct models nationally, including the Shark pickup and the Yuan Pro.

The stakes for hitting full production capacity (integral assembly involving welding and painting) by July 2026 are financial as well as operational. Brazil’s import tariffs on EVs with Chinese components, which rose to 18% in mid-2024, are scheduled to hit 35% in July 2026. Domestic production is the only way to maintain the aggressive pricing strategies that allowed BYD to capture significant market share in 2024 and 2025.

By the close of 2027, BYD aims to have eight distinct models rolling off those lines, covering everything from compact urban EVs to family-sized SUVs and perhaps even commercial vans. This ramp-up is backed by a staggering investment: Reports peg the initial outlay at over R$3 billion (about $550 million USD at current rates), with potential for more as production scales. The Camaçari plant, formerly a Ford facility that shuttered in 2021, has been revitalized with cutting-edge tech, including automated assembly lines and sustainable energy systems powered by BYD's own solar panels and battery tech.

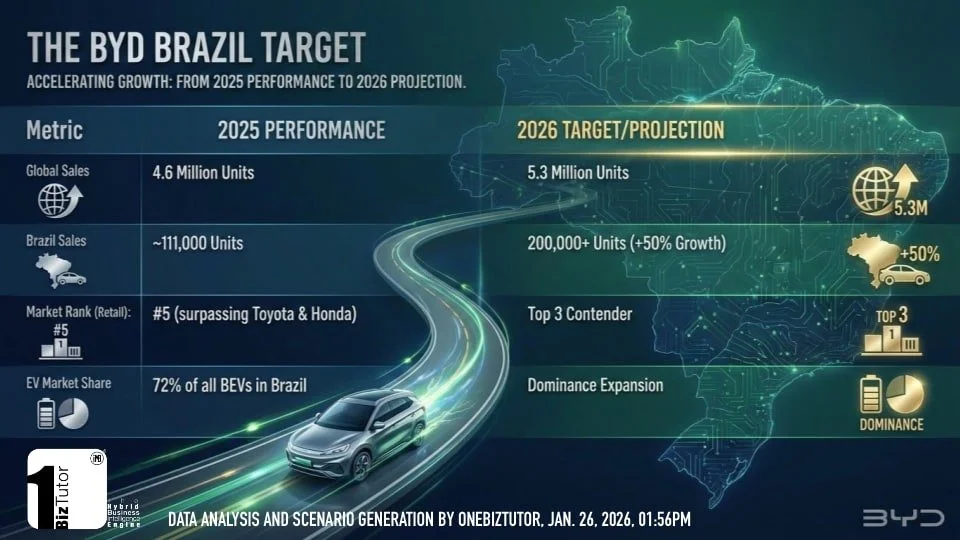

But here's where it gets really motivating: BYD's growth target for Brazil in 2026 is a whopping +50% year-over-year. If they hit that – and given their track record in China and Europe, it's not a stretch – they'll be neck-and-neck with Toyota in sales volume here. Toyota, the longtime market leader, sold around 200,000 units in Brazil last year; BYD's aiming to match or exceed that, building on their 2025 sales of roughly 130,000 vehicles. That's not just growth; that's a seismic shift in a market where EVs currently make up only about 5% of total sales, but are projected to hit 20% by 2030 thanks to incentives like tax breaks and import tariffs favoring local production.

It's like BYD looked at Brazil's vast landscapes, from the Amazon to the urban sprawl of São Paulo, and said:

And they're not wrong; with our abundant renewable energy sources (hello, hydropower and biofuels), Brazil is primed to become an EV powerhouse.

Analyzing the Strategy: Why Brazil, Why Now?

So, why is BYD betting big on Brazil?

Let's think outside the box here. Brazil isn't just a market; it's a strategic beachhead for Latin America.

Our population of over 200 million, growing middle class, and government push for green mobility make it irresistible. President Lula's administration has been vocal about industrial revitalization, offering subsidies for EV production and infrastructure – think charging stations sprouting up along the BR-101 highway. BYD's move aligns perfectly with Brazil's "New Industry Brazil" plan, which emphasizes sustainable tech and job creation.

Economically, it's a masterstroke. By localizing production, BYD dodges hefty import duties (up to 35% on foreign vehicles) and taps into the Mercosur trade bloc for exports to Argentina, Uruguay, and beyond. The Camaçari location? Genius. Bahia's port access streamlines logistics, and the region's skilled workforce – many ex-Ford employees – means quick ramp-up. Plus, BYD's vertical integration (they make their own batteries, motors, and even semiconductors) gives them a cost edge over rivals like Volkswagen or GM, who are still playing catch-up on EVs.

From a competitive lens, this pits BYD directly against established players. Toyota's hybrid dominance could face real pressure if BYD's affordable EVs (starting at around US$ 30,000 for models like the Dolphin) gain traction. And let's not forget the environmental angle: Brazil's commitment to net-zero by 2050 means EVs are the future. BYD's blade battery tech, known for safety and longevity, could win over skeptical consumers worried about range anxiety in our long-haul driving culture.

But here's our clear opinion: This isn't without risks. Supply chain hiccups from global chip shortages or lithium price swings could derail timelines. Political winds might shift – elections in 2026 could alter incentives. And culturally, Brazilians love their flex-fuel cars; convincing them to plug in will require savvy marketing. Yet, we are optimistic. BYD's agility, honed in China's cutthroat market, positions them to adapt and thrive.

The Ripple Effects: Opportunities and Challenges for Brazil

Proactively speaking, this is a boom for our economy. The factory alone could create 5,000 direct jobs by 2027, plus thousands more in suppliers and services. Imagine the knock-on effects: Local battery recycling plants, tech hubs in Salvador, or even EV tourism routes showcasing Bahia's beaches powered by green energy. For investors, BYD's Brazilian subsidiary (listed on B3? Fingers crossed for an IPO …) could be a hot ticket, especially with global EV stocks like Tesla fluctuating.

On the flip side, incumbents might struggle. If BYD captures market share, we could see factory closures or mergers – but that's evolution, right? Solution-oriented as always, we would advise Brazilian firms to partner up:

Thinking innovatively, what if BYD integrates with Brazil's biofuels? Hybrid EV-biofuel models could be a world-first, blending our ethanol expertise with their battery prowess. Or picture solar-powered charging networks in remote areas, bridging urban-rural divides. These aren't pipe dreams; they're actionable paths to sustainable growth.

The "Toyota Parity" Target and Market Disruption

While the Brazilian vehicle market grew by roughly 2.1% to 2.8% in 2025, the internal dynamics shifted violently.

Toyota's Contraction: The Japanese automaker saw passenger vehicle sales plummet by 21.3% in 2025, dropping to approximately 121,874 units. Despite the success of the Corolla Cross, Toyota has struggled to match the technology-to-price ratio offered by Chinese New Energy Vehicles (NEVs).

BYD's Surge: Conversely, BYD posted double-digit gains and climbed two spots in the national rankings. In August 2025 alone, BYD sales soared 46.4% year-on-year.

OneBizTutor® isn’t just rethinking business validation—it’s reinventing it as a high-velocity, intelligence-driven service.

The target for 2026 is a further +50% growth rate. To achieve this, BYD is not just relying on electrification but adapting to Brazil’s unique energy matrix.

By 2026's end, if that +50% growth materializes, BYD could sell 200,000+ units, rivaling Toyota's stronghold. Key models like the Song Plus SUV and Yuan Up compact will lead the charge, with pricing undercutting imports by 20-30%. Marketing will be crucial – expect celebrity endorsements, Carnaval tie-ins, and demo events at beaches. Globally, this bolsters BYD's ambition to hit 3 million annual sales worldwide, with Brazil as a key pillar.

The Technological Secret Weapon Pivot: Bio-Hybrid Warfare

The battleground for the Brazilian market is not pure electrification, but "Bio-Hybrid" technology. Brazil’s vast sugarcane ethanol infrastructure makes 100% electric vehicles (BEVs) a harder sell in the interior regions than in Europe or China.

Recognizing this, BYD invested US$ 20 million into developing a flex-fuel plug-in hybrid (PHEV) engine capable of running on both gasoline and ethanol. This effectively neutralizes the primary advantage held by Toyota (which pioneered the flex-hybrid Corolla) and Stellantis.

Stellantis Strikes Back: Stellantis, currently the market leader with a 31.4% share, is not ceding ground quietly. The conglomerate announced a record €5.6 billion investment in South America, largely allocated to its own Bio-Hybrid technologies developed at the Betim facility.

This creates a direct technological clash: Chinese speed and vertical integration versus Western legacy infrastructure and deep distribution networks.

The Policy Catalyst: MOVER Program

The acceleration of these investments is underpinned by the Brazilian government's MOVER (Green Mobility and Innovation) program. Launched to replace Rota 2030, MOVER offers approximately US$ 4.8 billion in tax credits through 2028 for companies that invest in decarbonization and R&D.

Critically, MOVER adopts a "well-to-wheel" emissions measurement. This methodology accounts for the energy source, favoring vehicles powered by Brazil's clean electric grid (88% renewable) and ethanol over traditional fossil fuels. By localizing battery production and refining lithium within Brazil, BYD ensures compliance with MOVER’s local content requirements, unlocking fiscal benefits that further depress their unit costs.

Geopolitical Implications: The Export Hub

The Camaçari plant is not solely for domestic consumption. It is designed as an export hub for the entire Latin American bloc. Under Mercosur trade rules, vehicles manufactured in Brazil can be exported to Argentina, Uruguay, and Paraguay tariff-free.

This creates a "backdoor" for Chinese technology to permeate South America without facing the prohibitive duties levied on direct imports from China. With the U.S. and Europe tightening trade restrictions, Brazil provides Chinese automakers a geopolitical hedge—a friendly, resource-rich jurisdiction from which to project commercial power across the Global South. President Lula has even expressed ambitions for the plant to export vehicles to the African continent.

Outlook for 2026

The year 2026 will be defined by the "scale-up" phase.

Infrastructure: The success of EV adoption relies on charging networks. Brazil reached nearly 15,000 charging stations by early 2025, but expanding into the interior remains a bottleneck.

Labor & Logistics: BYD must navigate Brazilian labor laws and supply chain complexities. Initial investigations into outsourced labor practices at the Camaçari construction site highlight the friction of rapid expansion.

Competition: With VW, GM, and Honda also ramping up hybrid investments for 2026 launches, the window for BYD to consolidate its dominance is narrowing.

The resurrection of Camaçari signifies more than the opening of a factory; it marks the moment Brazil transitioned from a passive consumer of Western automotive technology to an active partner in the Asian energy transition.

Your Action Items: Stay Ahead of the Curve

Fellow subscribers, let's make this dialogue-oriented – what do you think? Drop us a line on X, Bluesky, LinkedIn, Substack or reply to this newsletter. In the meantime, here's how to capitalize:

For Businesses: Scout supply chain opportunities. If you're in logistics or parts, reach out to BYD's procurement team now.

For Investors: Monitor BYD's stock (SHE:002594) and Brazilian EV funds. Diversify into related sectors like mining (lithium from Minas Gerais!).

For Consumers: Test-drive a BYD soon. With incentives, owning an EV could save you US$ 2,000/year on fuel.

For Policymakers (if you're reading): Push for more charging infra – let's aim for 50,000 stations by 2030.

In closing, BYD's Brazilian gambit isn't just about cars; it's about powering a brighter, greener future. It's motivating to see such innovation landing on our shores. Let's charge forward together – the road ahead is electric!

Until next time, keep spotting those Grey Rhinos,

The iMB.Solutions Team

P.S. If this sparked ideas, subscribe for more RoundUps and let's connect on X, Bluesky, Substack or LinkedIn for real-time chats!

Sign up with your email address and smash the subscribe button!

The LatAm Story

From Liberalization to Protection: Mexico's 2026 Trade Shift Targets $120B China Deficit

Preface

Mexico's bold new chapter in trade policy kicked off on January 1, 2026, marking a decisive pivot toward protecting domestic industry and rebalancing global dependencies. With tariffs now in force on 1,463 product classifications from countries lacking free trade agreements with Mexico—including heavyweights like China, Russia, South Korea, India, Vietnam, Thailand, and Brazil—this move signals a proactive strategy to foster local production, safeguard jobs, and align more closely with North American integration efforts.

Ciudad de México (D.F.)

President Claudia Sheinbaum's administration has implemented increases ranging from 5% to 50% on over 1,000 affected goods. High-impact categories include electric vehicles (often hitting the maximum 50%), auto parts, cosmetics, plastics, steel, textiles, footwear, toys, furniture, appliances, glass, soaps, and much more. These tariffs target imports primarily from non-FTA partners, where China stands out as Mexico's second-largest trading partner (after the United States), with annual purchases exceeding US$ 129 billion against exports of roughly US$ 9 billion—yielding a persistent US$ 120 billion trade deficit.

The government projects this policy will generate substantial revenue—estimates hover around 30 billion pesos annually (though some sources suggest up to 70 billion pesos in additional collections)—while keeping inflationary pressure minimal at just 0.2%, according to the Ministry of Finance. Critically, all basic food basket items from these countries remain exempt throughout 2026, ensuring everyday essentials stay affordable for Mexican families.

This isn't merely a revenue play; it's a cornerstone of Sheinbaum's ambitious import substitution vision under Plan Mexico.

The goal?

Enable Mexican companies to meet 50% of domestic supply and consumption needs, reindustrialize key sectors, correct trade distortions, and protect around 350,000 local jobs. The Ministry of Economy has committed to mechanisms that ensure competitive input supplies remain available, demonstrating a thoughtful, solution-focused approach amid the changes.

Experts view this as a true turning point.

After four decades of unilateral liberalization since joining GATT in 1986—transforming Mexico into a manufacturing powerhouse and FDI magnet—the era of unchecked openness has ended.

Ignacio Martínez Cortés from UNAM's Laboratory for Analysis in Trade, Economics, and Business aptly notes that this shift mirrors broader geopolitical realities, particularly with renewed U.S. protectionism under President Trump. In many ways, Mexico's tariffs serve as a strategic alignment with Washington's agenda, curbing potential "backdoor" Chinese transshipment routes into North America ahead of the USMCA review in July 2026. With over 80% of Mexican exports flowing through this agreement (generating more than US$ 500 billion annually), preserving and strengthening USMCA stability is paramount.

Reactions have been mixed, as expected in such transformative times. China quickly voiced opposition and initiated its own review for possible countermeasures, while South Korean and Indian exporters raised concerns. Domestically, some businesses worry about rising costs and supply chain disruptions, yet others applaud the push for greater self-reliance and local manufacturing strength.

Our clear take away: This is a courageous, forward-thinking step. In a world of escalating trade tensions, passivity isn't an option. By prioritizing domestic resilience without blanket protectionism—exempting essentials and maintaining FTA advantages—Mexico positions itself as a proactive player rather than a reactive one. Importers and companies now face a pivotal opportunity: adapt suppliers, invest in local alternatives, or optimize under programs like IMMEX to mitigate impacts.

The real test begins now. Which firms will innovate and thrive under this new framework? How swiftly can production chains restructure? The coming months will reveal the winners—and Mexico's potential to emerge stronger, more balanced, and truly competitive on the global stage is immense. Let's stay engaged as this unfolds; the rewards for bold, strategic action could redefine Mexico's economic future for decades. What are your thoughts on this shift—challenge or golden opportunity?—from Monterrey, México, February 2026, iMB.Solutions-Team MEX

Sign up with your email address to receive news and updates!

Generative AI Tools in Project Missions

Step into the AI Arsenal: the cutting-edge generative tools we deploy in client projects, internal operations, and partner collaborations—tested, trusted, and ready for battle.

What Can Hyperfox Do?

Hyperfox is a B2B order automation platform built specifically for distribution, logistics, and related industries. At its core, it acts as a smart "control layer" that centralizes, validates, and routes orders from chaotic, multi-channel sources into your existing ERP (Enterprise Resource Planning) or TMS (Transportation Management System) setups. No need for massive overhauls—it's plug-and-play, which is a game-changer for businesses bogged down by manual processes.

Here's a quick rundown of its key capabilities:

Multi-Channel Order Capture: It pulls in orders from emails (handling PDFs, Excel files, images, even audio), EDI/API integrations, field sales apps, personalized web forms, and self-service customer portals. Imagine turning a messy inbox into a seamless workflow—Hyperfox uses AI to parse and extract data automatically.

Validation and Routing: Before anything hits your backend systems, it checks orders against custom business rules, customer agreements, and delivery constraints. This catches errors early, ensuring only clean, compliant data moves forward.

Specialized Modules:

Email automation for instant processing.

EDI handling for electronic data interchange.

Mobile-friendly field sales tools for reps on the go.

Custom order forms and portals that empower customers to self-serve, reducing back-office burdens.

Integrations and AI Smarts: It connects effortlessly with standard ERPs/TMS via APIs, SDKs, or file imports/exports. The AI component shines in automating complex tasks like email-to-ERP conversions or transport requests, slashing processing times dramatically (e.g., from 15 minutes to 2 per order in some cases).

Scalability Features: Real-time status tracking, error reduction, and support for industries like food, pharmaceuticals, retail, and transport. It's trusted by companies such as Joma Sports, Distrilog, and Farmapunt, who report handling more volume with the same team.

In essence, Hyperfox isn't just software—it's a efficiency engine for B2B ops, targeting mid-to-large organizations dealing with high-volume, error-prone order intake.

Pricing starts with flexible plans (though details are ROI-based and customizable via their site—think starting around €500-€2000/month depending on modules, with potential free trials for testing), making it accessible for targeted implementations.

Pros and Cons of Hyperfox

Based on our experience from project missions in 2025 and still running, industry descriptions from our clients, and limited external reviews (it's a niche tool, so feedback is mostly positive and from their ecosystem), here's our clear-eyed take.

Hyperfox punches above its weight in logistics-heavy scenarios, but it's not a one-size-fits-all silver bullet.

Pros:

Time and Error Savings: Users rave about cutting order processing from minutes to seconds—think 80-90% reductions in manual entry, freeing teams for strategic work. One COO called it a "world of difference" for customer service focus. This directly supports sustainable growth without headcount bloat.

Scalability and Flexibility: Handles diverse channels without system migrations, ideal for growing B2B models. AI-driven automation ensures accuracy, and integrations are "plug-and-play," minimizing downtime.

Cost-Effective ROI: Testimonials highlight doing more with less—e.g., handling increased orders with the same team, which aligns with lean transformations. It's particularly strong in compliance-heavy sectors like pharma or logistics.

User-Friendly Adoption: Quick setup and positive feedback on reducing "daily chaos," making it a low-friction tool for change-resistant teams.

Cons:

Niche Focus: It's laser-targeted at order automation in distribution/logistics, so if your client's pain points are elsewhere (e.g., full supply chain analytics or CRM), it might feel limited. No built-in advanced reporting or AI for predictive insights—it's more tactical than strategic.

Dependency on Data Quality: AI works best with structured inputs; messy, inconsistent emails could require initial tweaks, potentially adding setup time (though users say it's minimal).

Limited External Reviews: As a specialized European tool (based in Belgium), there's scant independent critique—most insights come from their site or partners. This means potential unknowns in global scalability, like localization for South American markets (e.g., Portuguese/Spanish support isn't explicitly highlighted). We applied the software within project missions with European companies.

Pricing Opacity: Plans are customized via ROI calculators, which could lead to variable costs. If not scaled right, smaller clients might find it overkill compared to free tools like Zapier for basic automation.

Overall, our opinion? The pros outweigh the cons for the right fit—it's a solid 8/10 for efficiency boosts, but pair it with broader tools for comprehensive transformations.

How iMB.Solutions Can Use Hyperfox Effectively in Your Projects

At iMB.Solutions, with your 21+ years of expertise in interim management, business development, reorganization, and business model shifts—especially in emerging markets like Brazil and Mexico—Hyperfox could be a secret weapon to accelerate client outcomes. Our people-centric, innovative approach (we love that OneBizTutor® hybrid AI-human model!) pairs beautifully with this tool, turning abstract strategies into tangible efficiencies. Think outside the box: We don't just recommend it— we integrate it into our implementation-oriented consulting to deliver faster ROI. Here's how, proactively mapped to our core areas, with examples from our case studies:

In Business Reorganization Projects: Using Hyperfox to streamline order intake during operational overhauls, reducing manual workloads and errors that often plague post-crisis recoveries. For instance, in our Rio de Janeiro mechanical engineering case (reorganization), where we identified growth opportunities, Hyperfox automates supplier/distributor orders via email/EDI, freeing up teams to focus on core engineering. Proactively, during our interim management phase, pilot it to validate process flows—aim for 50% time savings, motivating our client with quick wins and aligning with your emphasis on efficient project execution.

In Business Development Initiatives: We leverage it for scaling without proportional costs, perfect for market entry or expansion. In our 2025 coffee shop franchise transformation project mission—introducing personalization and digital migration—Hyperfox's customer portals and order forms automated B2B supply orders (test runs, from franchisees to central hubs), enabling asset sharing and growth. Innovatively, combine it with our OneBizTutor®: Use our AI engine to strategize the rollout, then deploy Hyperfox for execution. This may creates a "transformation stack" that's cost-effective and protects IP.

In Business Model Transformation: This is where Hyperfox shines for digital shifts—replacing informal processes with automated, compliant workflows. Take our European automotive supplier's nearshoring project mission in Mexico in 2025: With process mining via GenAI, we optimized logistics; Hyperfox extended that by automating order routing to TMS, navigating regulatory hurdles through rule-based validation. Think hybrid innovation: Integrate it with local suppliers for seamless collaboration, turning a traditional model into an agile, B2B powerhouse. Solution-oriented tip—start with a proof-of-concept in one channel (e.g., email automation), measure ROI (e.g., error reduction metrics), and scale across the client's ecosystem. This not only refines process flows but empowers your clients to "do more with less," echoing our integrity-driven ethos.

To get started proactively: Audit a client's current order chaos, demo Hyperfox's AI modules, and tie it to our OneBizTutor® for customized plans.

What Can GenPPT Do?

GenPPT is an AI-driven presentation generator that transforms simple text inputs—such as topics, prompts, or outlines—into fully structured PowerPoint slides, complete with coherent content, logical flow, and basic professional designs. It's built for users who need quick, content-focused decks without starting from a blank canvas.

click on image above and access GenPPT - hyperlink inside

Here's how it works in a nutshell:

Input Process: You start by logging in, entering a topic (e.g., "Business Model Transformation for a Brazilian Coffee Franchise"), or providing text content. The AI then generates an editable outline.

Generation and Editing: Click "Generate" to create slides automatically. Refine them manually or via an integrated AI chatbot—think of it as chatting with a smart assistant to tweak content conversationally, without fiddling with formatting. It pulls in stock images (searchable by keyword) and ensures relevance, drawing on advanced models like Gemini 2.5 Pro for research and structuring.

Key Features: Supports multilingual content, team collaboration, unlimited slide generation (with premium plans), free auxiliary tools like an AI Outline Generator, Title Generator, and JSON-to-PPT converter. Outputs are exportable as PowerPoint (.pptx), Google Slides, or PDF.

Target Use Cases: Ideal for consultants, educators, and professionals crafting pitches, lesson plans, or reports. It emphasizes content quality over flashy visuals, making it a solid choice for idea-to-deck workflows.

In essence, GenPPT handles the heavy lifting of research, organization, and initial design, turning hours of work into minutes. No more wrestling with PowerPoint like it's an untamed rhino—it's streamlined and efficient, though it shines best for drafts rather than pixel-perfect finals.

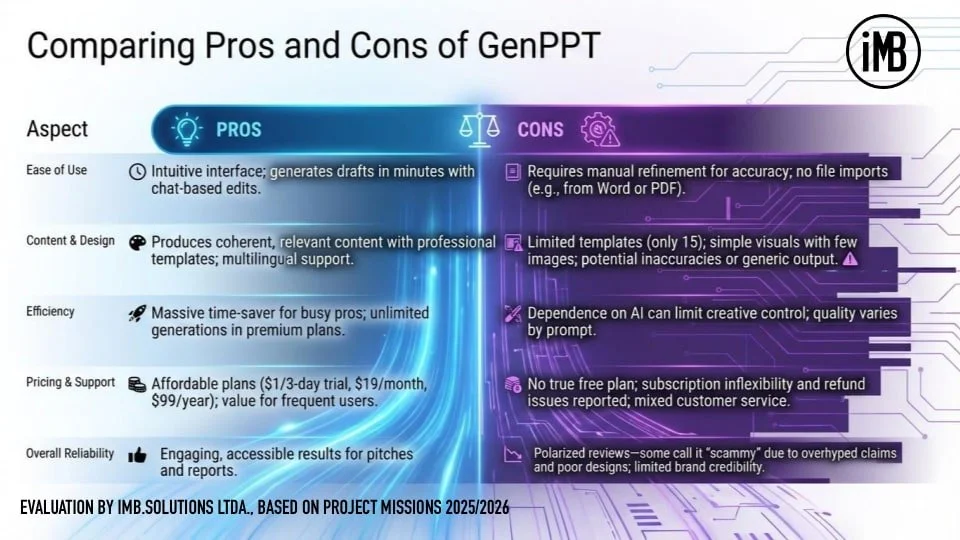

Pros and Cons of GenPPT

Based on our reviews and experience analyses, GenPPT earns mixed but generally positive feedback, with an average rating of 3/5 from a small sample. It's praised for speed but criticized for limitations in customization and reliability. In our opinion, it's a strong contender for time-strapped teams like ours at iMB.Solutions, where quick iterations can accelerate client engagements—but it won't replace human oversight for complex, nuanced strategies.

To make this clear, here's a balanced comparison in table form:

Overall, the pros tilt toward efficiency and accessibility, could making it a win for solution-oriented teams. The cons? They're manageable with a hybrid approach—use it as a starting point, not the endgame.

How iMB.Solutions Can Use GenPPT Effectively in Your Projects

At iMB.Solutions, with our expertise in interim management, reorganization, business development and business model transformation GenPPT aligns as a proactive accelerator. With our already leverage AI-human hybrids like OneBizTutor® for strategic plans—we experimented with layering GenPPT on top for visual storytelling, but without convincing results.

In Reorganization Projects: Using GenPPT to rapidly prototype restructuring roadmaps. Input prompts like "Operational reorganization for a Mexican automotive supplier under USMCA regulations," and let it generate slides outlining process flows, cost savings, and timelines. Pros: It saves hours on drafting, letting your team focus on execution and client buy-in. To address cons, cross-check AI content with our process mining methodologies for accuracy—then refine via the chatbot for that iMB.Solutions polish. Our quick take: This could cut project kickoff time by 50%, turning chaos into clarity faster. Maybe.

In Business Development: For growth initiatives, like bridging staffing gaps or seizing market opportunities in South America, create pitch decks on the fly. Prompt with "Business development strategy for entering the Brazilian coffee market via collaborative ecosystems." Export to Google Slides for team collaboration, integrating with our multidisciplinary project partners. Innovative twist: Combine with OneBizTutor®—use it to validate ideas first, then feed the output into GenPPT for visuals. Output: acceptable. Nothing more.

In Business Model Transformation: Transform abstract concepts into tangible visuals. For instance, input "Business model shift to asset sharing for a São Paulo franchise chain," and generate decks with diagrams, examples, and transformation phases. Leverage the stock images for engaging visuals on personalization or ecosystems. Solution tip: To overcome limited templates, start with GenPPT's output and customize in PowerPoint using your brand guidelines—ensuring integrity and trust, core to your approach. Think creatively: Use the free AI Outline Generator to brainstorm disruptive ideas during strategy sessions, then build full presentations.

To get started effectively: Begin with the $1 trial to test on a real project, like a nearshoring pitch for Mexico. Train your team on prompt engineering for better results—e.g., include specifics like "Incorporate USMCA compliance and logistics optimization." Monitor for cons like inaccuracies by always layering your human expertise.

Type your email, smash the subscribe button and get the next edition in your email inbox!

GRhino Quick Take

Dear GreyRhino RoundUp Readers / Subscribers,

we are thrilled to announce the launch of our new visual companion: GRhino Quick Take — the animated insight channel powered by iMB.Solutions. 🦏⚡

click on image above and access the GRhino Quick Take YouTube channel

If you've been enjoying the sharp, no-nonsense newsletter takes in your inbox on hidden risks, overlooked opportunities, and real-world business dynamics, you'll love this next step. GRhino Quick Take brings those same frontline insights to life in crisp, animated videos — all under 7 minutes.

What to expect:

Quick Takes on business development, transformation, reorganization, interim & management-on-demand wins, plus those elusive hidden opportunities.

Every episode drawn directly from active client project missions, current executive discussions, and pressing leadership challenges — zero armchair theory, pure clarity from the trenches.

Fast, visual breakdowns that make complex issues instantly understandable and actionable.

Professional animations that distill high-stakes realities into frameworks you can apply today.

Whether it's decoding a tricky reorg, revealing the real ROI of interim leadership, explaining how tools like OneBizTutor® build trust across layers, or spotting the next "grey rhino" before it charges — these short videos deliver the aha moments you need, when you need them.

Head over now and subscribe:

Turn on notifications so you never miss a drop — we're starting strong with foundational pieces on the EU-Mercosul, project missions, OneBizTutor and our core approach, with deeper transformation & reorg content rolling out weekly.

From spotting the rhino in the newsletter → to seeing exactly how to handle it in motion on YouTube.

Clarity in motion. Let's transform faster together. 🦏⚡

Best regards, iMB.Solutions & GreyRhino Squad

P.S. Drop a comment on the first videos with the business challenge you'd most like animated next — your input shapes the queue!

Step into the timeless world of Agnès Varda's lens, where everyday moments become poetic masterpieces! Captured these gems at her stunning exhibition at Instituto Moreira Salles on Avenida Paulista, São Paulo. First up: A vibrant street scene in Cuba, embodying the rhythm of life in the 1960s—pure energy and connection that reminds us to embrace our own journeys with flair. Then, shifting to Italy: A young girl strides confidently past a massive wall, her silhouette a striking contrast to the urban backdrop, symbolizing resilience and the beauty of fleeting encounters. Varda's work isn't just photography; it's a call to action—see the world anew, challenge norms, and create your own stories. If you're in SP, don't miss this; it's fuel for the soul!

Short Description of the Exhibition

The "Fotografia AGNÈS VARDA Cinema" exhibition at Instituto Moreira Salles (IMS Paulista) in São Paulo showcases approximately 200 photographs by the pioneering Belgian-born French artist Agnès Varda, spanning the 1950s to 1960s. It intertwines her photographic oeuvre with elements of her cinematic legacy, highlighting themes of politics, society, and existentialism through intimate portraits and street scenes from places like Cuba, China, and beyond. Running from November 29, 2025, to April 12, 2026, this free-entry show invites visitors to explore Varda's innovative vision, encouraging a deeper appreciation for how images can provoke thought and inspire change in our fast-paced world. If you're seeking creative motivation, this is a must-visit—it's not just an exhibit; it's a solution for reigniting your artistic spark!

Contact

defjeöjfjejri

You want to subscribe to the newsletter? OK, take your smartphone and scan the QR code!

Discover What Matters Most to You—Backed by 140+ Project Missions!

Curious about the impact of our insights at iMB.Solutions? We put our articles, blogs, and case studies to the test—running three independent AI-driven queries with Perplexity, Google Gemini, and Mistral. The result? A powerful keyword cloud reflecting the topics that truly resonate.

Do you see yourself in these trends? Let’s connect and explore how our expertise—shaped by 140+ project missions over two decades—can drive your success.